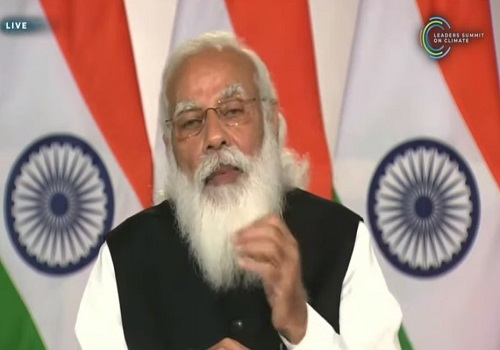

Quote on Morning market 11 February 2022 By Dr. V K Vijayakumar, Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is quote on Morning market 11 February 2022 By Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

"US inflation in January came worse-than-expected at 7.5% pushing the 10-year yield to 2.03% discounting a hawkish Fed, which may raise rates by at least by 100 bp this year. A rate hike by even 50 bp in March is looking increasingly probable now. This is not good news for global equity markets.

Back home in India, our central bank is singing an ultra-dovish tune by taking a pro-growth risk. This is certainly good for GDP growth and equity markets, but it remains to be seen whether RBI's inflation target of 4.5% for FY 23 will be achieved.

The short-term market texture is now influenced by aggressive DII buying (Rs 5635cr during last 5 days) dominating over FII selling. The fact that FIIs are now increasing their longs and reducing their shorts in the derivative market also is significant.

DIIs buying the beaten down financials, which are attractively valued, is a smart strategy. There is a message here for individual investors"

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

View on Bank Nifty : The index once surpasses the mentioned hurdle will see a strong move Sa...