Outgoing Australian central bank Governor warns against inflation threat

Outgoing Governor of the Reserve Bank of Australia (RBA), Philip Lowe on Friday warned against the ongoing threat of inflation despite signs that it is easing.

In an opening statement of his last hearing to the House of Representatives Standing Committee on Economics, Lowe said while goods price inflation has slowed considerably, the prices of many services are continuing to increase strongly and the momentum in rent inflation is particularly strong, reports Xinhua news agency.

He said the RBA has made progress in getting on top of the high inflation rate, and things are moving in the right direction, "but it is too early to declare victory".

Lowe warned that high inflation is "corrosive" to the healthy functioning of the economy, and it makes life more difficult for everybody, especially those on low incomes.

"The Australian economy is currently experiencing a period of below-trend growth and this is expected to continue for a while yet," he said.

To curb the high inflation rate, the central bank has lifted the official cash rate by four percentage points since May last year, the most aggressive increase in interest rates since the 1980s.

Lowe acknowledged that many households are "facing a painful squeeze on budgets", and the increase in interest rates also weighs on their disposable incomes. However, he still signaled that interest rates could climb further.

"Looking forward, it is possible that some further tightening of monetary policy will be required to ensure that inflation returns to target within a reasonable timeframe. Whether this is the case will depend upon the data and the board's evolving assessment of the outlook and risks."

The RBA expects consumer price index inflation to return within the 2 to 3 per cent target range by late 2025.

Lowe also warned against two substantial risks to the economic outlook, one is the outlook for household consumption that is fast changing, and the other is that services inflation remains high for longer.

Tag News

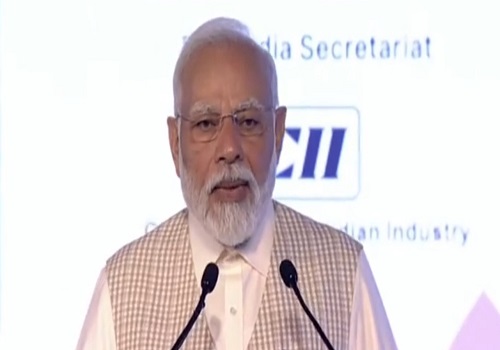

PM Narendra Modi congratulates RBI Governor for receiving A+ rating in Global Finance Centra...