Our markets had a pathetic start for the new trading week - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (47883) / Nifty (14311)

Our markets started the week with a gap down on back of worries over rising cases of Covid-19 in our country in this second wave. Our markets completely ignored the global cues yesterday and post the gap down, we witnessed a sell-off across and ended the day tad above 14300, with a deep cut of over three and a half percent.

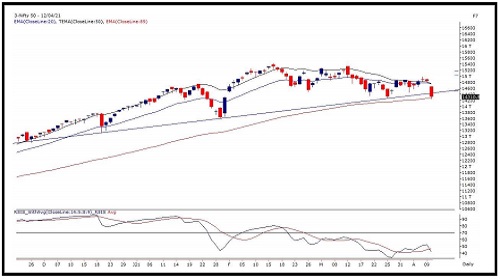

The rising cases of Covid -19 and a fear of probable lockdown in some parts of the country led to a sell-off in our markets which resulted in a huge underperformance compared to the global peers. Post the gap down, there were no major pullbacks during intraday and the Nifty even breached 14250 mark in the last hour before ending the session tad above 14300. Nifty has breached its ‘Rising Trendline’ support and has ended around the 25th March swing low.

The range of 14264- 14240 is the immediate support zone which is the swing low and the ‘89 day exponential moving average’. Below this, the retracement support comes in the range of 14070-14000. Although the index is nearing its important levels, it would be prudent to avoid aggressive bets and watch for the price momentum as the broader markets have witnessed sharp sell-off. On the flipside, 14465 and 14590 would now be the immediate resistances on pullback moves.

The Banking and Financial stocks which have good weightage in the Nifty index as well have been under-performing recently and many stocks from this sector witnessed a cut of 5-10 percent yesterday. The only relative outperforming space yesterday were the Pharma stocks. However, although a positive traction was witnessed in most of the stocks from this sector at the start of the day, but at the end the momentum shifted to only fewer names. Thus, it is advisable to stay light on positions and avoid aggressive bets ahead of the mid-week holiday and keep a watch on how the index behaves around the above mentioned levels.

Nifty Daily Chart

Nifty Bank Outlook - (30792)

Our markets had a pathetic start for the new trading week led by the financials as we saw BANKNIFTY opened with a massive cut of nearly 800 points. In fact, things became worst in the initial trades after it dropping further to violate Budget day’s low.

During the remaining part of the day, there was no respite seen in banking counters to test the 30500 mark. Eventually, despite a tiny bounce towards the fag end, the banking index posted a biggest percentage wise single day fall in the recent months. Since last week and a half, the BANKNIFTY was hovering around its strong support zone of 32400 – 32200.

The bulls were not letting this support break and were making numerous attempts to rebound. But since there was no conviction seen in this attempt, we remained sceptical on all intraday recoveries and did not get carried away by the momentum. We also highlighted how bottoms are made in a hurry and it does not take this much time as it was taking since few days.

This was a clear indication of banking index breaking this support zone and yesterday at the opening itself, these levels were breached brutally. Now the way BANKNIFTY plummeted like a bottomless pit, any recovery in next few days is not likely to sustain. Hence, 31000 – 31300 are to be treated as immediate hurdles now and on the downside, 30200 – 29700 can be tested soon.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One