Nifty started the session on a flat note yesterday and consolidated within a narrow range - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (50614) / Nifty (14896)

Nifty started the session on a flat note yesterday and consolidated within a narrow range for the first hour of trade. However, the index witnessed buying interest in this initial dip and then Nifty gradually moved higher for the rest of the day to end with gains of over 100 points.

The early hiccup in the first hour of trade witnessed a good buying interest and the markets then continued its momentum to end the weekly expiry around 14900. The banking index continued its outperformance and the broader markets too saw good momentum. As of now, the momentum continues to be bullish as even minor intraday dips are getting bought into.

Hence, traders are advised to continue to trade with a positive bias and look for stock specific opportunities. As far as levels are concerned, Nifty has ended near the rising trendline at 14900 and a continuation of this upmove should lead the index towards 15070. On the flipside, the immediate supports for Nifty are placed around 14770 and 14640.

Nifty Daily Chart

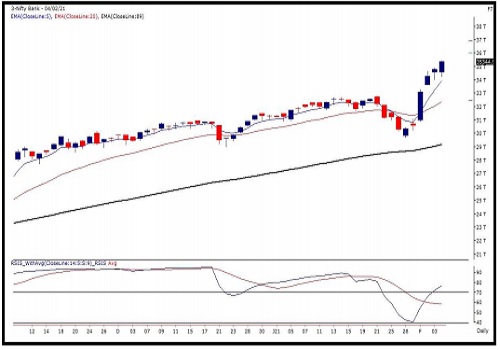

Nifty Bank Outlook - (35345)

Markets had a tentative start yesterday owing to sluggish global cues. In the initial hour, banking stocks saw some profit booking; but the mighty bulls managed to regain strength and grab this early decline with both hands. In the remaining part of the session, BANKNIFTY maintained its positive posture by having higher highs and higher lows.

Eventually, the bulls added another one and half a percent to their tally to conclude the weekly expiry at fresh highs above 35000. This has been a mesmerising rally in banking stocks since the budget session. Before anyone could realised, some of the banking heavyweights have come to their unimaginable levels in such a short span. This is how market operates and each day here is new learning curve for us.

Although the trend has been strong and there is no weakness yet, we do not want to get gung ho and hence, traders are advised to take some money off the table now. Since banking index is in an uncharted territory, there are no specific levels to watch; but psychologically 35500 - 36000 can be considered as immediate points. On the flipside, 35000 - 34600 - 34200 to be seen as intraday supports.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Cooperation in digital payments, space, agri, MSME, pharma sectors to boost India-Uzbekistan...

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One