Nifty started the day on a flat note, but corrected in the first hour of the trade to mark - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

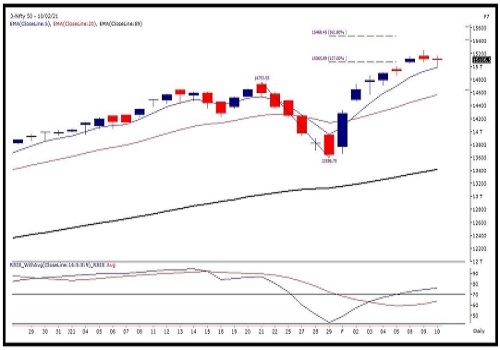

Sensex Chart (51309) / Nifty (15106)

Nifty started the day on a flat note, but corrected in the first hour of the trade to mark a low tad above the 15000 mark. We witnessed some pullback before noon towards 15125 but again some profit booking emerged and the index sneaked below the 15000 level.

But it was not over yet, we again saw a recovery at the end and the index managed to recover the losses and end this roller coaster day on a flat note. Although the indices traded within a range yesterday, we saw a tug-ofwar between the bulls and the bears and at the end, the Nifty managed to recover its intraday losses.

The overall chart structure still remains positive but such bouts of profit booking was much expected after the recent run up. Now, 15000-14975 is seen as an immediate support range for Nifty while resistance is seen around 15260. Below this mentioned support, 23.6% retracement of the recent upmove would be the next support which comes around 14860.

While day traders would have to look for opportunities on both the sides of the trade, positional traders should keep a buy-on-dip approach and look for buying opportunities on declines. It is advisable to avoid aggressive trades and prefer stock specific approach till we consolidate within this range.

Nifty Daily Chart

Nifty Bank Outlook - (35783)

We had a flat opening yesterday despite positive global cues. The banking index looked weak right from the beginning which resulted in a decent profit booking in the entire banking space as the day progressed. At one point post mid-session, the BANKNIFTY had a sharp drop to sneak below crucial Friday’s low of 35545.

However, the mighty bulls were still not willing to give up; because they came back strong and pulled the banking index convincingly above this important support on a closing basis. Since last couple of sessions, we have been mentioning how BANKNIFTY is placed at a crucial junction and till the time 36600 is not crossed, we are likely to see some pressure at higher levels.

This is exactly what we have been witnessing and in fact yesterday at one point, the BANKNIFTY even sneaked below 35545. A sustenance below this crucial level would have led to a confirmation of a ‘Gravestone Doji’ pattern formed last Friday. Fortunately, banking index immediately managed to recover fair bit of ground and defended this low on a closing basis. Yesterday’s recovery from lower levels is a sign of strength; but if we meticulously observe the intraday chart, 36000 – 36200 seems to be a strong resistance zone now.

Traders are continuously advised not to create aggressive longs; because a close below 35500 would lead to a decent profit booking in coming days. Let see how things pan out on the weekly expiry session, which is likely to offer some higher volatility.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Quote on Bank Nifty: The index to resume the up move must surpass the level of 43,500 Says ...