Nifty should trade positive with support at 14700 - ICICI Direct

Nifty should trade positive with support at 14700…

* The Nifty witnessed a sharp pullback above 14800 after making lows below 14300 last Thursday. Year-end buying can be attributed to across the board buying seen during the truncated week. Moreover, highest ever GST numbers helped in improving sentiments further as the Nifty closed at the highest levels seen since mid-March. The Nifty gained almost 2.5% during the week while midcap and small cap saw gains of more than 3.5% during the week. Going ahead, we expect the Nifty to find fresh upside momentum if it is able to sustain itself above 14700

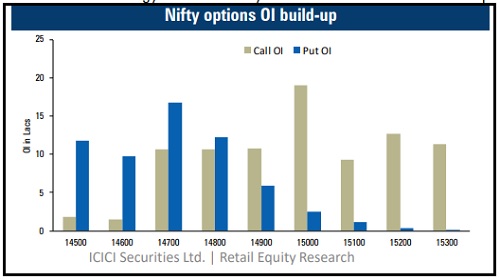

* From the options space, while Call base remains at 15000 Call strike, the Put base has inched up and moved to 14700 strike. Despite a truncated week once again, options prices are richly valued, clearly suggesting expectations of volatility next week as well. We believe levels of 14700 should be important support for the Nifty in the short-term and further strength can be seen if we see closure among Call strikes

* Post February, we have seen continued decline in volatility index, which suggests more of a consolidation in broader markets and the Nifty has been largely in the range of 14500 to 15200 since then. A major change of trend may be seen once the Nifty moves out of this range. While stock specific moves are likely to continue in the upcoming result season, we expect the Nifty to remain largely in this range

* While the metal space has significantly out performed by gaining almost 9% last week, continued strength cannot be ruled out in the FMCG and pharma space. On the other hand, the banking space continued to underperform and witnessed selling pressure at every rise, declines among heavyweights have been used as buying opportunity. With the upcoming result season, a round of short covering cannot be ruled out in the banking space if it is able to sustain above 34200. Technology stocks are likely to remain in focus ahead of their quarterly results

Bank Nifty: 33000 remains crucial for upsides to continue…

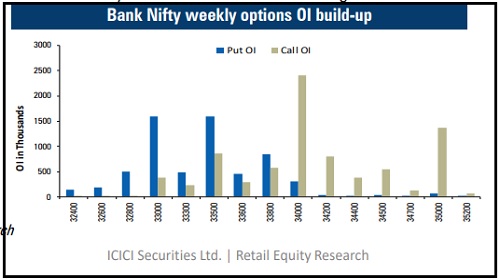

* Broader markets recovered after the sharp sell-off last week. Nifty futures moved above 14900 whereas Bank Nifty future moved above its sizeable Call base of 34000. Both private as well as public banks did well but leader like HDFC Bank remained under pressure due to recent restriction post technical glitch

* As the Bank Nifty started at a two and half year high OI, we saw marginal closure in OI on the last day of the week. The premiums rose significantly, which is pointing towards expectations of continued volatility in the market. However, recent lows near 33000 remains crucial support for banking index

* On the data front, both 33000 and 33500 Puts hold almost same OI indicating major supports. At the same time, significant Call OI base is placed at 34000 Call strike. In recent days, due to a sharp rise in intraday moves, option premiums has become expensive due to which short Strangle strategies are formed in the index. We feel current upsides should find further momentum once the Bank Nifty moves above 34200

* The current price ratio of Bank Nifty/Nifty declined marginally to 2.28 levels. We feel no major outperformance will take place in the Bank Nifty during the week. It is most likely to consolidate in a broader range

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer