Nifty immediate support around 14600 in current uptrend - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty immediate support around 14600 in current uptrend…

* The Nifty exhibited strong reversal post Budget and witnessed one of the best weekly returns since 2009 as it gained almost 10% during the week. Once again, the banking space took the lead as the Bank Nifty moved up almost 20% in the week triggered by both PSU and private sector heavyweights

* Despite the sharp up move, the volatility index has remained elevated and did not move below 23. While closure among Call writers can be attributed to elevated volatility, we believe volatility levels will decline from here onwards. Sustainability at current levels may be considered a sign of caution after recent sharp upsides

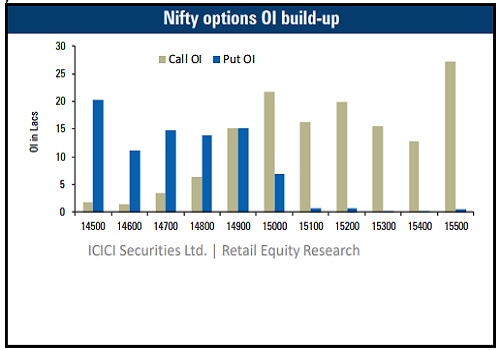

* From a data perspective, significant Call option concentration was at ATM 15000 strike for both weekly and monthly settlement. Further closure of positions can take the index above these levels. On downsides, incremental Put writing was seen at 14700 strike, which remains immediate support for the index. The Nifty has started the new series with relatively low open interest and despite the recent up move, no major OI accumulation was seen suggesting low leverage

* Sectorally, the infrastructure and banking space along with the PSU space took the lead in the current move. We believe stocks with low leverage are likely to perform well in the coming sessions. Marginal profit booking in the technology and pharma space can be seen as a fresh re-entry opportunity

Bank Nifty: Uptrend to continue. Index may head towards 37000…

* Bank Nifty futures rallied almost 5500 points last week and managed to surpass their Call base of 36000. However, post the RBI monetary policy, profit booking was visible and it reverted sharply from higher levels. During the week, stocks like IndusInd Bank, SBI and Axis Bank outperformed whereas supportive price action was also there in other PSU banks

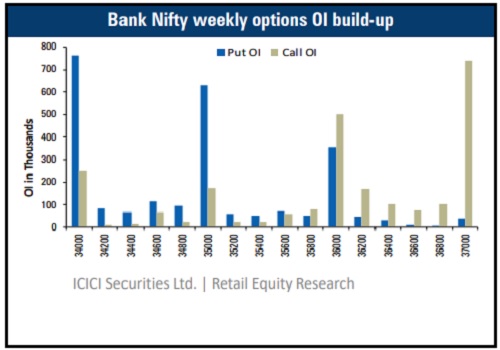

* Even after the event outcome, IVs continue to remain at elevated levels, which provided added advantage to option writers. Deep OTM strike, which is 2000 points far saw good build-up in OI positions indicating broader trading range in coming days

* Bank Nifty futures is trading almost at par with spot as heavyweights like HDFC Bank and Kotak Bank slipped into discount last week whereas others are trading at minor premiums. When the reversal take place, sharp moves are expected as cash based buying was visible and same activity could be seen in futures

* As of now the sizeable Call base for the Bank Nifty is placed at 36500 from where it reverted last Friday whereas highest base is at 37000. We feel profit booking could extend and the Bank Nifty could test its intermediate support of 35000 from where rally towards 37000 is possible

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct