Nifty gyrated in a range with higher volatility and eventually managed to extend losses - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (48348) / Nifty (14239)

Monday morning, the global set up was just ideal to have a good head start for the final week of the January month. However, within few minutes of trade, market skidded sharply to not only pare down all gains but also entered a negative territory.

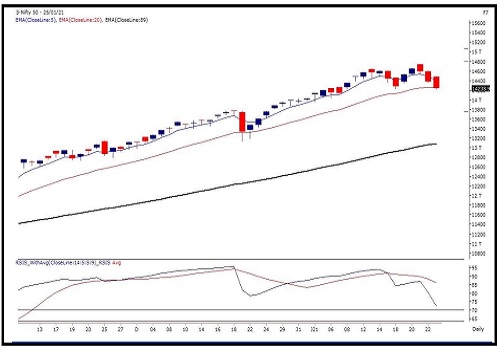

For the remaining few hours, Nifty gyrated in a range with higher volatility and eventually managed to extend losses in last couple of hours to close tad below the 14250 mark. On Friday, markets had hinted towards some weakness and the bears used Monday’s gap up opening to add bearish bets at higher levels. The major culprit in Monday’s sell off was RELIANCE, after its quarterly numbers along with few financial stocks. However, the tail end correction was mainly led by the sudden nosedive in few IT heavyweights.

The banking had a solid knock on Friday, which has already weakened its short term trend and Monday, Nifty had a catch up move to this. At the close, Nifty is placed at crucial swing low of 14222, which remained unbroken on a closing basis. However, the way charts are shaped up, the possibility of sliding below this level is quite high to test 14100 – 14000 levels. On the flipside, 14360 – 14500 are likely to act as Immediate hurdles.

We continue with our cautious stance on the market and as mentioned in the previous commentary, traders are advised to stay light on positions. Generally, market does not give any major trend reversal ahead of the mega event; but this time, it looks like we are going to witness yet another unprecedented behaviour of the market. Next couple of days would be quite crucial and would be interesting to see whether markets correct further or it shows some resilience to protect it’s crucial supports.

Nifty Daily Chart

Nifty Bank Outlook - (31198)

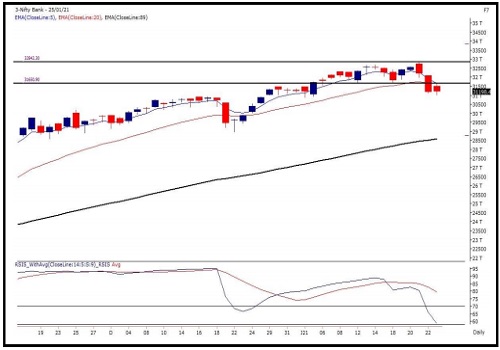

BankNifty aswell started on a positive note on Monday however it witnessed selling pressure at higher levels to trade choppy for the major part of the session. Eventually, in the last hour, a strong selloff was seen to erase all morning gains to end around Friday's close with negligible change tad at 31200.

In our previous outlook, we had mentioned a double top breakdown and any bounce likely to get sold into. This is what we exactly saw on Monday when the bank index witnessed a bounce the breakdown level acted as a stiff barrier. Going ahead, we sense the bank nifty is likely to remain under pressure and any bounce is likely to get sold into.

Traders are hence advised to keep positions light and avoid undue risk ahead of the key event. As far as levels are concerned, immediate support is placed at 30900 - 30450 levels whereas resistance is seen around 31700 - 32000 levels.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Nifty is respecting its 20-DMA where 15900 is an immediate resistance - Swastika Investmart