Monthly Commodities Outlook: Gold Likely to continue downward trend till 49,000 By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Gold

• Comex gold prices remained quite volatile and tested $1622 level last month. Despite the recent recovery, it lost almost 3.2% last month after the US Fed raised its key interest rate by 75 basis points to 3.25% and remained hawkish for further aggressive interest rate hikes in coming meetings

• At the same time, a continuous drop in initial jobless claims from the US weighed down gold prices. The number of Americans filing new claims for unemployment benefits fell from 243,000 to 193,000 last month, the lowest since the end of April, pointing to an increasingly tight labour market and adding more fear for further interest rate hikes by the Federal Reserve

• However, gold found some support from the geopolitical front as Russian President Vladimir Putin's move to mobilise more troops over the conflict in Ukraine drew investors to the safe-haven asset

• MCX gold prices are expected to trade with a negative bias due to strengthening US dollar index and rising US 10-years treasury yields. Currently, it is trading below support levels of 200 DMA, which is around | 50,500. As long as it sustains below this level, it is likely to move down towards | 49,000 in the coming month

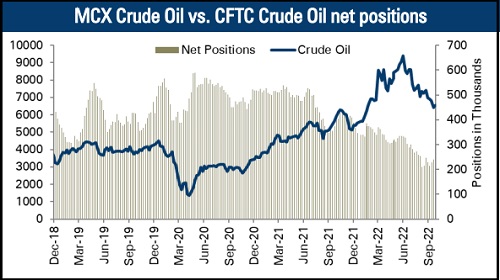

Crude oil

• MCX crude oil prices remained under pressure and dropped almost 9% last month on concerns about the prospects of more interest rate hikes from major central banks hampering growth and weakening fuel demand

• Additionally, crude oil prices slumped below levels seen prior to Russia's invasion of Ukraine in January as weak Chinese trade data forced investors to worry about recession risks

• Further, crude oil prices were pressurised by a tentative agreement that would avert a US rail strike and expectations of weaker global crude oil demand

• However, further downside was prevented after data showed Opec+ is now producing crude oil below its targets by a record 3.58 million barrels per day about 3.5% of global demand

• Hence, we expect MCX crude oil price to face resistance at | 6800. As long as it sustains below this level, it is likely to get dragged down towards | 6,200 level for this month

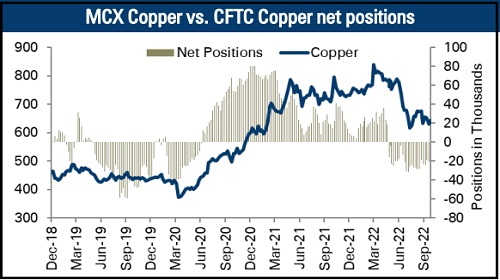

Copper

• MCX copper prices remained volatile, fell almost 0.70% and touched 671.90 levels last month as the threat of rising interest rates dampened the economic growth outlook and dented demand for base metals

• At the same time, the Caixin China general manufacturing PMI unexpectedly fell to 48.1 in September 2022 from 49.5 in the previous month amid the impact of Covid controls. This was the lowest reading since May, as output fell for the first time in four months, which weighed on copper prices

• Further, copper prices were pressurised as London Metal Exchange (LME) warehouses saw 11,200 tonnes of copper arrivals, the largest single-day warranting since June

• However, sharp downside was restricted as Shanghai announced 1.8-trillion-yuan investment worth of infrastructure projects, heeding national policymakers' calls to revive slow economic growth

• MCX copper prices are expected to edge lower towards | 600 levels on concerns that aggressive interest rate hikes by the major central banks may trigger recession and eventually will hurt base metals demand

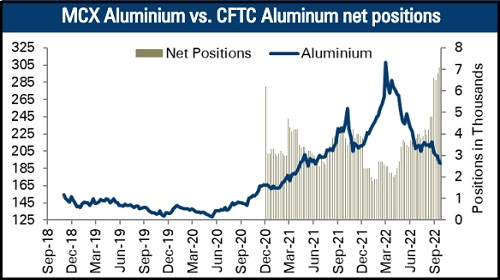

Aluminium

• MCX Aluminium prices tumbled more than 7% to their lowest since March 2021 amid recession risk due to strengthening dollar. Also, pricing pressure came due to sanction threat on the biggest aluminium producer Rusal. The discounts given by the company has pressurised prices amid weakened demand and put significant pressure on the commodity

• Further, aluminium prices were pressurised as the threat of rising interest rates by major central banks dampened the economic growth outlook and hammered base metals demand

• Moreover, China's aluminium output climbed to a second straight monthly record in August at 3.5 million tonnes, up 9.6% from the same month a year earlier, as new production capacity came on line more than offsetting curbs on power use in some areas, weighed on aluminium prices

• However, further downside was restricted as Europe continued to fight with a power crisis that has reduced production of the energy-intensive metal

• MCX aluminium prices are likely to continue their downward trend towards | 178 levels in coming months amid Russian supply uncertainty, which will weigh on aluminium prices

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer