Markets likely to make slightly positive start; WPI data eyed

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Indian markets -- Sensex and Nifty ended lower on Monday amid selling in banking and financial stocks. Today, the markets are likely to make slightly positive start after lower inflation (CPI) numbers amid mixed global cues. Investors will be eyeing the wholesale inflation numbers to be out later in the day. Traders will be taking encouragement with the government data showing that India's retail inflation in August marginally eased to 5.3%, staying within Reserve Bank of India's comfort zone for a second month. Inflation in the food basket was 3.11% in August compared to 3.96% in the preceding month. Traders may take note of report that the oil marketing companies (OMCs) kept petrol, diesel prices unchanged on Tuesday for the ninth day in a row. Accordingly, the price of petrol and diesel was static at Rs 101.19 and Rs 88.62 per litre in Delhi, as per Indian Oil Corporation, the country's largest fuel retailer. Meanwhile, Indian Space research Organisation Chairman K. Sivan said India will soon come out with a new foreign direct investment (FDI) policy for the space sector. There will be some reaction in insurance industry stocks as Regulator IRDAI allowed insurers to continue selling and renewing short-term Covid specific health insurance policies till March 2022. Amid rising number of coronavirus cases in the country, the Insurance Regulatory and Development Authority of India (IRDAI) had last year asked all insurance companies to come out with Corona Kavach policies (standard indemnity based health policy) and Corona Rakshak policies (standard benefit-based health policy). Besides, two new companies - Ami Organics and Vijaya Diagnostic Centre are scheduled to make their stock market debut on Tuesday, September 14, 2021. The Rs 570-crore Ami Organics IPO was subscribed by 64.54 times and the Rs 1,895-crore IPO of Vijaya Diagnostic received 4.54 times subscription. Apart from this, Auto component maker Sansera Engineering’s Rs 1,283-crore IPO will open for subscription today. The company has mopped up Rs 382 crore from anchor investors ahead of its IPO.

The US markets ended mostly higher on Monday with energy companies leading the gains as crude oil extended a rally to a six-week high. Asian markets are trading mixed on Tuesday as investors look ahead to the release of US consumer inflation data for August.

Back home, Indian equity benchmarks ended a lacklustre trading session marginally lower on Monday dragged by losses in Reliance Industries, ICICI Bank, Hindustan Unilever among others. Benchmark indices started the week on a choppy note amid weak global cues. Traders were concerned as a periodic labour force survey by the National Statistical Office (NSO) showed that unemployment rate for all ages in urban areas rose to 10.3 per cent in October-December 2020 as compared to 7.9 per cent in the corresponding months a year ago. Some cautiousness also came in as India Ratings and Research (Ind-Ra) said that salaried and wages earners will be a drag on overall economic recovery in medium term due to tepid recovery of household consumption. Indian indices extended its early losses in a volatile session, ahead of the Consumer Price Index (CPI) data scheduled to be released later today. However, buying around lower levels helped benchmarks recover most of their intraday losses in noon deals. Traders also found some solace with Reserve Bank of India (RBI) Governor Shaktikanta Das’ statement that central bank is quite optimistic about its 9.5 percent GDP growth estimate coming true for FY22, and will take steps to gradually move for a cool off in headline inflation to its 4 per cent target. He said the growth will keep rising from a sequential perspective with every quarter, and expected the September quarter to be better than June. Some support also came with data showing that Industrial production surged 11.5 per cent in July mainly due to a low-base effect and good performance by manufacturing, mining and power sectors but the output remained slightly below the pre-pandemic level. Meanwhile, the commerce ministry's investigation arm DGTR has recommended the imposition of anti-dumping duty on certain aluminium products from China to guard domestic manufacturers from cheap imports. Finally, the BSE Sensex fell 127.31 points or 0.22% to 58,177.76 and the CNX Nifty was down by 13.95 points or 0.08% to 17,355.30.

Above views are of the author and not of the website kindly read disclaimer

Top News

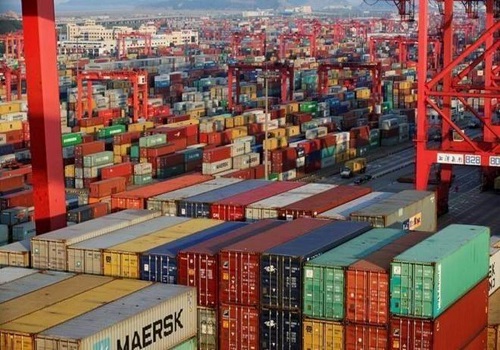

Imposition of restrictions by states to contain rising coronavirus cases could affect export...

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

The NIFTY Edges Higher - GEPL Capital