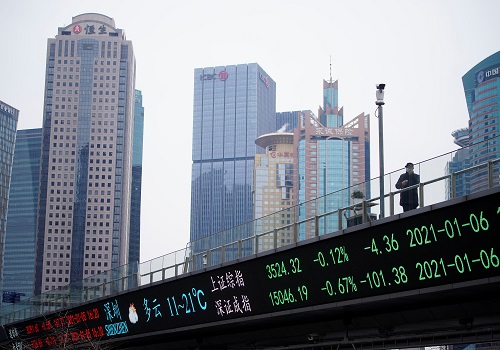

Markets likely to make flat-to-negative start on Tuesday

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets ended near record close on Monday, boosted by metals and financials, as investors hoped for a strong corporate earnings season. Today, the markets are likely to make flat-to-negative start despite broadly positive cues from Asian peers. Fear of inflationary pressures due to higher energy costs might keep the indices under pressure after OPEC+ nations called off talks on output levels. However, some respite may come later in the day as India recorded 34,067 new infections, lowest since March 18. The total caseload has surged to 30,618,939, while 29,744,831 have recovered. some support will come as data from the Reserve Bank of India showed the government's Emergency Credit Line Guarantee Scheme (ECLGS) significantly boosted credit growth for the micro, small and medium enterprises (MSMEs) in the financial year ending March 2021 even as concerns about asset quality of this segment grew. Traders may take note of SBI research report stating that household debt has sharply jumped to 37.3 per cent of the GDP in the pandemic year from 32.5 per cent in FY20, confirming the deeper financial impact of COVID-19. It also warned that the ratio may rise further this fiscal due to the second wave of the pandemic. Oil marketing companies (OMCs) will be in the spotlight in amid the oil price surge. There will be some buzz in Aviation stocks as the government increased the seating capacity of domestic airlines to 65 percent from the current 50 percent. Cement and logistics companies stocks will be in focus as the spread of the second wave of Covid-19 infections to rural regions in the country, coupled with subsequent lockdown restrictions by several states, has affected domestic cement production in the first quarter of FY22. Noting this demand hit, Icra ratings revised cement volumetric growth estimates for FY22 to 10-12 per cent from 15 per cent earlier. There will be some reaction in FMCG companies stocks with a report stating that leading FMCG companies in the country are expecting their sales growth numbers in high double digit in the April-June quarter, a period when the broader market was severely impacted by the second wave of the COVID-19 pandemic. Meanwhile, the much-awaited initial public offering (IPO) of Zomato could hit Dalal Street soon after capital markets regulator SEBI approved the offer as proposed in the DRHP. Zomato plans Rs 8,250 crore public issue which will be an amalgamation of fresh issue of equity shares and an offer for sale (OFS).

The US markets were closed on Monday for the Independence Day holiday. Asian markets are trading mostly higher on Tuesday as investors look ahead to the Australian central bank’s interest rate decision.

Back home, marking the second straight day of gains, Indian equity benchmarks ended with gains of over half percent on Monday amid strong gains in realty, Metal and Banking stocks. Domestic indices witnessed a gap-up opening and maintained the levels in morning deals, as sentiments got a boost as India recorded the highest-ever exports of $95 billion during April-June, up 85 per cent Y-o-Y and 18 per cent higher than the first quarter of the fiscal year 2019-20. The merchandise exports grew 47 per cent Y-o-Y to $32.46 billion in June, driven by a robust demand of engineering goods, petroleum products, and gems and jewellery in the external markets. Some optimism also came with Union Finance Minister Nirmala Sitharaman’s statement that the government has been proactive in responding to the challenges caused by COVID-19 and is also taking up substantial reforms despite the pandemic. Besides, in reversal of a two-month selling trend, foreign portfolio investors (FPIs) in June turned out to be net buyers by investing Rs 13,269 crore in Indian markets. Headline indices added some gains in late afternoon session, taking support from Commerce and Industry Minister Piyush Goyal’s statement that India has set a target of $400 billion merchandise exports for 2021-22 (FY22). He mentioned ‘In collaboration with private industry, MSME sector, engineering, agriculture, automobile, steel sector, we have set an export target of $400 billion. We all will work together to achieve this target.’ Further, he said India's economy is growing and exports are also growing. Market participants paid no heed towards a private survey showed activity in India's dominant services sector contracted sharply in June as tighter restrictions to contain a resurgence of coronavirus cases hammered demand and forced firms to shed jobs at a rapid clip. IHS Markit's Services Purchasing Managers' Index plunged to 41.2 last month from an already depressed 46.4 in May. That was its lowest reading since July 2020 and well below the 50-level separating growth from contraction. Finally, the BSE Sensex rose 395.33 points or 0.75% to 52,880.00, while the CNX Nifty was up by 112.15 points or 0.71% to 15,834.35.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...