Markets likely to begin week in green tracking gains in global markets

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

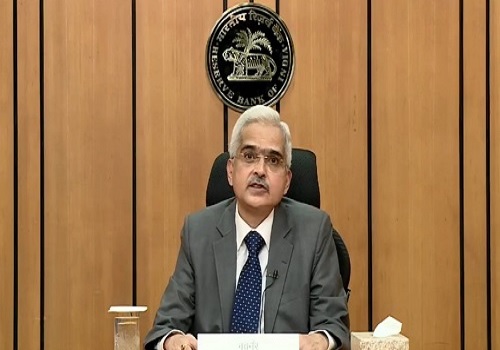

Indian markets rose to three-week closing highs on Friday, boosted by gains across most sectors, as the market entered the June futures & options series. Today, markets are likely to begin the week in the green, rising further from three-week closing highs, tracking gains in global markets. Traders will be taking encouragement as RBI data showed that India’s forex reserves increased by $4.23 billion to $597.509 billion for the week ended May 20 on the back of a high accretion of core currency assets. The country’s foreign exchange reserves had declined by $2.676 billion to $593.279 billion in the previous reporting week ended May 13. Some support will come with report that State finances showed improvement in 2021-22 as the consolidated gross fiscal deficit (GFD) of 26 states was lower by 31.5 per cent than a year ago. Traders may take note of report that making a strong case for structural reforms, the Reserve Bank said they are essential for sustained, balanced and inclusive growth, and also to deal with the after-effects of the pandemic. Besides, investors will be eyeing the GDP numbers to be out later in the week for further cues. A private report stated that India's economic recovery from the COVID-19 pandemic likely stumbled again in the first quarter of this year primarily due to Omicron-related restrictions and higher inflation. Traders may be concerned as the Reserve Bank warned that there is a risk of high wholesale price inflation (WPI) exerting pressure on retail inflation. Meanwhile, Prime Minister Narendra Modi will release the 11th installment of financial benefits worth Rs 21,000 crore under the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme to more than 10 crore farmers on May 31 in Shimla, Himachal Pradesh. Crude oil-related stocks will be in limelight as Brent crude has surged past $120/barrel-mark. Aviation, paint, tyre, cement, and oil marketing companies (OMCs) may be negatively impacted, while oil exploration firms could gain. There will be some reaction in power stocks with a private report that a lower pre-monsoon coal stock at thermal power plants in India is suggestive of another power crisis in July-August. Ethos’ Rs 472-crore IPO, which was subscribed 1.04 times, will be making stock market debut on Monday, 30 May 2022. The issue had received bids for 41.39 lakh shares against the 39.78 lakh shares on offer, and was sold at a price band of Rs 836-878 apiece. Also, leg of March quarter results will keep investors busy today.

The US markets ended higher on Friday as signs of peaking inflation and consumer resiliency sent investors into the long holiday weekend with growing optimism that the Federal Reserve will be able to tighten monetary policy without tipping the economy into recession. Asian markets are trading mostly in green on Monday as investors wager on an eventual slowdown in US monetary tightening following sharp rate hikes in the coming two months.

Back home, bulls remained in control on Dalal Street for the second day running and comfortable ended the day with gains of over a percent on Friday, led by strong buying support in IT, TECK and Capital Goods stocks amid a positive trend in global equities. Markets made optimistic start and stayed in green for whole day as traders got encouragement with economic research think-tank Centre for Monitoring Indian Economy (CMIE) has estimated that labour participation rate (LPR) was higher in rural India during the period January to April 2022. LPR, defined as the number of persons of the labour force employed as a percentage of working age population, is 40.9 in rural India as compared to 37.4 in urban India during the period January to April 2022. Some support also came with a private report that the Reserve Bank will opt for a larger, 0.50 per cent, hike in key rates at its next monetary policy review in June to protect medium term economic stability in face of the uncomfortable inflation situation. Besides, the government has waived late fees for two months till June for delayed filing of GST returns for financial year 2021-22 by small taxpayers registered under the composition scheme. Key gauges extended gains in late afternoon deals, amid a private report stating that India’s economy maintained its momentum in April as a wider reopening from the pandemic kept rising prices from depressing demand for the time being. Activity in the services sector as well as factories gained last month, while the three-month weighted averages of monthly changes in indicators from exports to credit demand suggested enduring strength. Sentiments remained positive as the government relaxed norms for ministries and department to utilise unspent amounts in the subsequent quarter in the same financial year in a bid to push public expenditure. Traders overlooked SBI’s statement that upcoming release of official data for economic performance is likely to register a 2.7 per cent growth for the January-March period, and the FY22 growth is expected to be 8.5 per cent. Meanwhile, Commerce and Industry Minister Piyush Goyal said the way things are progressing between the two negotiating teams, a free trade agreement (FTA) between India and the UK could be ready by Diwali without the need for an interim early harvest agreement. Finally, the BSE Sensex rose 632.13 points or 1.17% to 54,884.66 and the CNX Nifty was up by 182.30 points or 1.13% to 16,352.45.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Banknifty opened with an upward gap and remained in positive terrain throughout the day - Ax...