Markets had a slightly weak start yesterday as indicated by the SGX Nifty - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Sensex (51704) / Nifty (15209)

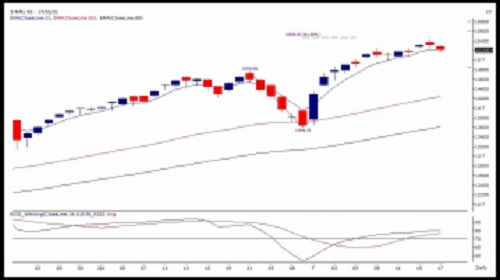

Markets had a slightly weak start yesterday as indicated by the SGX Nifty. During the initial hour, the correction extended to test the 15200 mark. However, immediately in the subsequent hour, we had a v-shaped recovery to recoup all gains to move towards Tuesday’s close. Market then consolidated for some time before resuming the downward move at the stroke of the mid-session. In fact, the weakness persisted towards the fag end to close almost at the lowest point of the day.

Since last couple of days, we have been advocating some caution after reaching a crucial resistance zone of 15380 – 15500 (which is the 161% ‘Golden Ratio’ of the entire fall from Jan’20 highs to March’20 lows). On Tuesday, we had a minor profit taking from high which extended yesterday to reach key support of 15200. Going ahead, one should keep a close eye on how market behaves around this level; because a breach of 15170 – 15150 would lead to further correction towards 15075 – 15000 levels. On the flipside, 15245 – 15315 will now be seen as intraday hurdles.

Traders are continuously advised to remain a bit cautious at higher levels and should start lightening up positions in the rally. Although, individual stocks are still performing well; it’s a daunting task to pick out such outperformers from the broader market.

.Nifty Daily Chart

Nifty Bank Outlook - (36911)

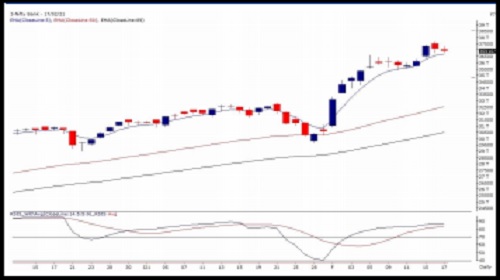

Bank Nifty as well started on a mild negative note and slipped to mark the intraday low of 36764. Subsequently, a bounce-back was seen to recover the entire loss however in the second half the bank nifty again slipped lower and consolidated to eventually end with half a percent loss at 36910. It was more of a range-bound session and the bank index ended with a small body candle. During the last week, the 36600 - 36700 acted as stiff resistance, and now in this week, the bank index for the last two sessions has seen support around these levels. For the coming session, 36700 will be closely watched as a break below the same can drag bank index further lower towards 36000 on the flip side, immediate resistance is placed around yesterday's high at 37330 above which the prices can retest all-time high levels. Traders are advised to keep a tab on these levels and traders accordingly.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaime

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Quote on Nifty: Nifty remained under the grip of the bears as investors booked profits post ...