Market had a surprising gap down on previous Friday - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Sensex (50405) / Nifty (14938)

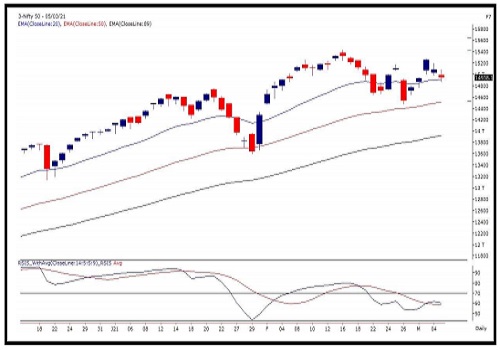

Market had a surprising gap down on previous Friday which was followed by extended sell off throughout the day to drag the Nifty towards 14500. The way it closed along with sharp uptick in ‘Volatility Index (VIX)’, some decent correction was on cards. But again to surprise everyone, markets had a gap up opening on Monday which was then followed by a v-shaped recovery for the three consecutive sessions. In the process, Nifty even managed to surpass the 15200 mark; however, market was not done with its twist yet.

Globally, markets had some jittery moves which had a rub off effect on our bourses as well. In last couple of sessions, we witnessed some correction to end the week with nearly three percent gains but trimmed some portion to close below 15000. It was a difficult week for momentum traders because the moment markets tried to decide its direction; we tend to have some surprises. Although, we did manage to recover well from previous Friday’s level, market left us with some doubts. As far as levels are concerned, 15100 and 15273 are to be seen as immediate hurdles; whereas on the lower side, 14760 – 14467 are to be seen as key supports.

If we take a glance at the weekly chart, we are still unsure whether market has enough strength to go beyond recent highs around 15400 – 15550 without seeing any decent price or time wise correction. But at the same time, they are just refusing to fall as well. Hence, it would be interesting to see how markets behave in the first half of this week. It should then ideally give us some fair idea where markets are heading in the short term. Traders are advised to focus on stock specific moves but should Sectorally, lot of themes did extremely well for the major part of the week.

But some of the pockets did cool off towards the end and ‘NIFTY MIDCAP 50’ was clearly one of them after registering record highs. Globally, commodities saw some decent correction and hence, it would be interesting to see how this theme play out as well. Very importantly, the financial space is placed at a crucial level and any weakness from hereon would lead to short term breakdown in this pocket as well.

Nifty Daily Chart

Nifty Bank Outlook - (35228)

Along with the broader markets, the bank nifty started with a gap down opening on Friday, and intraday bounce got sold into to mark an intraday low of 34893.

Eventually, some bounce was seen during the last hour to end with a loss of 1.60% at 35228. During the last week, the bank index relatively underperformed as compared to broader markets and then we witnessed a strong upmove on Wednesday; this move however was not enough to fill the bearish gap formed on the previous Friday. Now with the last two session's sell-off, the bank index is back to the recent lower range.

The bank index is on a make or break level with strong support around 34600 - 34700 levels and if it slips below it then we may see some sharp correction in the short term. On the flip side, if the bank index manages to hold the same then prices may remain in the range with bounce back likely to face resistance around 35800 - 36500 levels. Traders are advised to keep a watch on these levels and trade accordingly.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Market Quote : Markets are rising, assuming that we are in the last phase of the rate hike S...