MCX gold prices are expected to trade with a positive bias for the day amid continues drop in US 10 years bond yields - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Bullion Outlook

• Comex gold prices advanced almost 0.25% on Monday amid weak US dollar index

• Further, bullion prices were pushed higher as investors expect the US central bank to slow the pace of rate hikes from next monetary policy meetings

• Moreover, risk aversion in US markets and disappointing US macroeconomic data continuously supported bullion prices

• MCX gold prices are expected to trade with a positive bias for the day amid continues drop in US 10 years bond yields. It is likely to move towards the level of | 51,500 in coming session. Silver prices are expected to take cues from gold prices and may rally towards | 59,350 levels for the day

• Additionally, investors will remain cautious ahead of JOLTs Job Openings data from the US

Base Metal Outlook

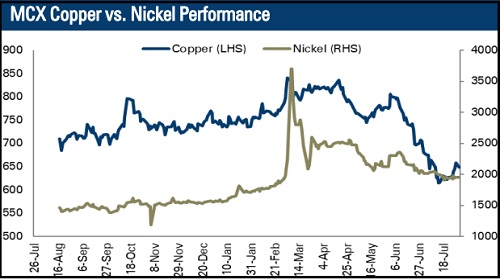

• MCX copper and aluminium prices declined on Monday due to disappointing manufacturing PMI data from the China

• The Caixin China General Manufacturing PMI declined to 50.4 in July 2022 from June’s 13 month high of 51.7 and missing market forecasts of 51.5 amid widespread COVID lockdowns and electricity shortages at some firms

• Moreover, industrial metals demand has been muted with reports showing weak factory activity across US and Europe in July, adding to fears of recession

• MCX copper prices are expected to trade with a negative bias for the day due to rise in copper LME warehouse inventories. It is likely to break the hurdle of | 647 to trade in downward trend towards the level of | 640 in the coming trading session

Energy Outlook

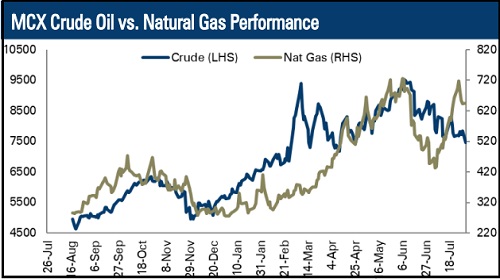

• WTI crude oil prices tumbled by almost 4.5% on Monday as OPEC oil output rises in July despite outages

• OPEC pumped 28.98 million barrels per day (bpd) of crude last month, an extra 310,000 bpd from June's revised total as rising supply from the Gulf offset outages in Nigeria and Libya

• At the same time, crude oil prices were pressurized after JP Morgan revised lower its global oil demand forecasts for this year and said oil prices tend to fall in all recessions by 30% to 40%

• MCX crude oil prices are expected to trade with a negative bias for the day due to expectations of higher oil production from the Gulf countries. It is likely to continue its downward trend towards the level of | 7140 in coming trading sessions

• Additionally, MCX natural gas prices are expected to trade towards the level of | 609 in coming session

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer