MCX gold prices are expected to trade with a negative bias due to firm dollar index - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Bullion Outlook

• Comex gold prices retreated around 1.60% on Thursday amid a sharp rise in US dollar index and on improved macroeconomic data from the US

• The number of Americans filing new claims for unemployment benefits surged to 203,000 from 202,000 for the week ended 07 May 2022

• Further, gold is highly sensitive to rising US interest rates, which increased the opportunity cost of holding non-yielding bullion

• MCX gold prices are expected to trade with a negative bias due to firm dollar index. It is trading below the key support levels of 100 day moving average (| 50,270). As long as it sustains below this level, it is likely to correct towards | 49,600 levels for the day. Silver prices are expected to take cues from gold prices and may move towards | 58,000 levels for the day

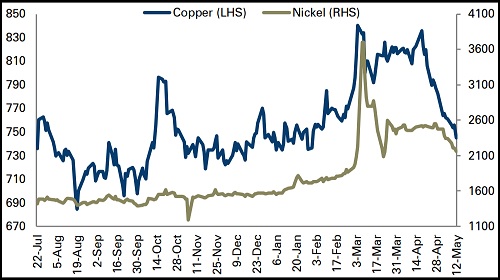

Base Metal Outlook

• LME Copper and other industrial metal prices declined on Thursday amid a concerns over liquidity crisis in the Chinese real estate market

• Chinese property market developer Sunac failed to pay a dollar-bond coupon before a Wednesday deadline, adding to a wave of defaults in the property market sector.

• Further, weakness in Chinese yuan and risk aversion in the global markets added downward pressure to the industrial metal prices.

• MCX copper prices are expected to trade with a negative bias for the day due to stronger dollar index and worries over China’s property market crisis. It is trading below the key support levels of 200 day moving average (| 755). As long as it sustains below this level, it is likely to slip towards | 730 levels for the day

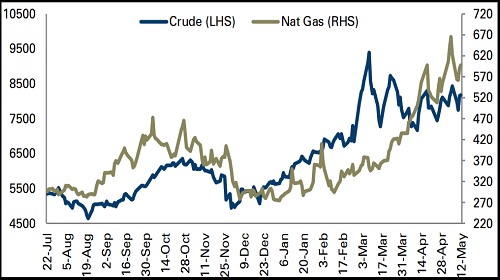

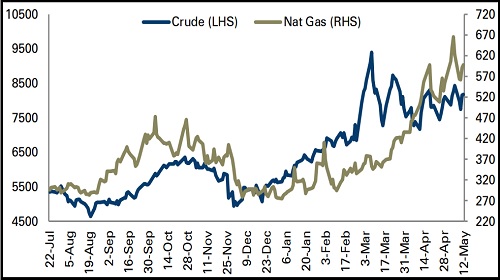

Energy Outlook

• WTI crude oil prices rallied around 0.40% on Thursday after Moscow imposed sanctions on European subsidiaries of state-owned Gazprom a day after Ukraine stopped a major gas transit route

• However, OPEC on Thursday cut its forecast for growth in world oil demand in 2022 for a second straight month, citing the impact of Russia's invasion of Ukraine and the resurgence of the Omicron coronavirus variant in China.

• US natural gas prices surged more than 1.0% on Thursday after the EIA reported that utilities added 76 billion cubic feet (bcf) of gas over the last week, which was lower than expected natural gas injection into storage.

• MCX Natural gas price are expected to rally further towards | 625 for the day due to worries over tight gas supply from Russia. Additionally, investors will keep an eye on rig counts data from the US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer