MCX gold prices are expected to trade with a negative bias due to elevated dollar index - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

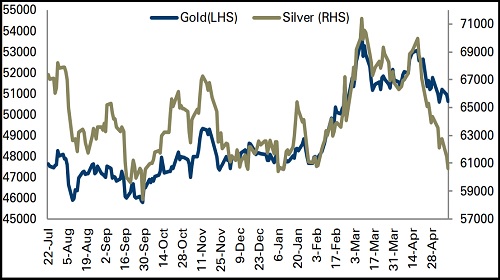

Bullion Outlook

• Comex gold prices eased 0.80% on Tuesday amid a optimistic sentiments in the global markets and on uptick in US dollar index

• Further, expectations of aggressive monetary policy tightening by US Fed dented the demand for safe haven assets

• However, a sharp decline in US 10 year bond yields and higher inflation prevented further downsides in bullion prices

• MCX gold prices are expected to trade with a negative bias due to elevated dollar index. It has been facing resistance at | 51,500 levels in the last couple of days. As long as it sustains below this level, it is likely to correct towards 100 day moving average, which is around | 50,200. Silver prices are expected to take cues from gold prices and may correct towards | 60,000 levels for the day. Also, investors remain cautious ahead of CPI inflation data from the US

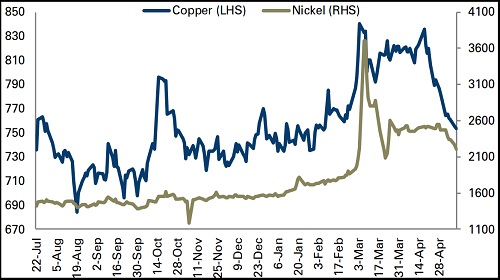

Base Metal Outlook

• LME Copper prices and other industrial metals declined on Tuesday as growing worries over industrial metal demand amid continued Covid-19 lockdown restrictions in China • Further, copper prices remained under pressure as worries about expectations of faster monetary policy tightening by US Fed pushed dollar index almost to a multi year high, making metals costlier for holders of other currencies • However, operations remain suspended in Peru's largest copper mine MMG Ltd’s Las Bambas while a sharp decline in LME copper inventories supported copper prices on lower side • MCX copper price is trading below the key support levels of 200 day moving average (| 755). As long as it sustains below this level, it is likely to slip towards | 740 levels for the day

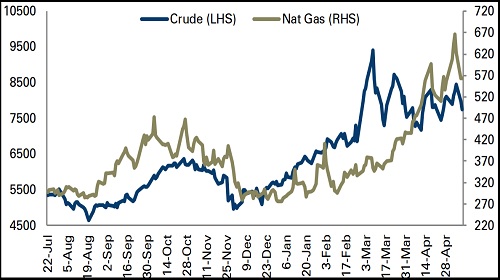

Energy Outlook

• WTI crude oil prices slipped more than 3.0% as China extended lockdowns and growing concerns over slowing global economic growth weighed on the outlook for fuel demand

• Moreover, European Union sanctions on Russian oil approval has been delayed amid requests from Eastern European members for exemptions and concessions, which has continued to pressurise oil prices on higher side

• Additionally, an EIA short term report showed US crude oil output is expected to rise 720,000 barrels per day to 11.91 million bpd in 2022

• MCX crude price is trading below the daily mean levels of | 7,960. As long as it sustains below this level, it is likely to correct towards mean2 sigma levels of | 7,490 in the coming days. Further, investors will keep an eye on crude oil stockpiles from the US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Evening Roundup : A Daily Report on Bullion, Energy & Base Metals for 20 October 2022 By Geo...