MCX copper and aluminium prices tumbled on Wednesday amid a rise in LME warehouse inventories - ICICI Direct

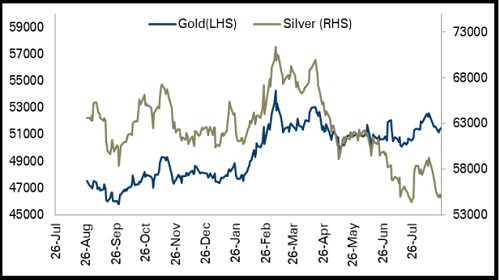

Bullion Outlook

• MCX gold prices advanced yesterday amid weak macroeconomic data from the US

• However, sharp upside was capped by a strong US dollar and rise in US 10 years bond yields

• MCX gold prices are expected to trade with a positive bias for the day amid expectations of weak macroeconomic data from the US. MCX Gold prices are likely to surpass the hurdle of | 51,530 to continue its upward trend towards the level of | 51,650

• Additionally, silver prices are likely to take cues from gold prices and move towards | 55,580 level in the coming session

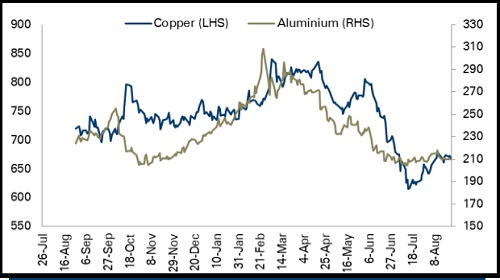

Base Metal Outlook

• MCX copper and aluminium prices tumbled on Wednesday amid a rise in LME warehouse inventories

• Further, copper prices were pressurised by concerns over a global economic slowdown, which may dent base metal demand

• However, stronger than expected pending home sales data from the US prevented further downside

• MCX copper prices are expected to ease for the day amid a strong US dollar. It is likely to trade in the range of | 673 to | 666 in the coming session

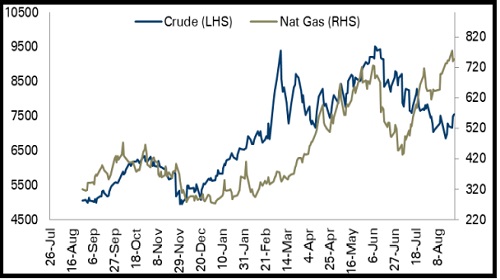

Energy Outlook

• MCX crude oil prices edged higher by 0.76% amid a drop in US commercial crude oil inventories from 424.9 mb to 421.7 mb last week

• Moreover, crude oil prices were supported on concerns that the US will not consider additional concessions to Iran in its response to a draft agreement that would restore Tehran's nuclear deal and potentially the Opec member's crude exports

• We expect MCX crude oil prices to trade with a positive bias for the day amid expectations that Organization of the Petroleum Exporting Countries could consider cutting output

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer