Key gauges extend gains; Nifty trades near 18K mark

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian equity benchmarks extended their gains in noon deals with Sensex and Nifty trading near 60,300 and 18,000 levels, respectively. Markets participants got boost after Government launched two consumer-centric initiatives by the Reserve Bank of India - the RBI Retail Direct Scheme and the Reserve Bank - Integrated Ombudsman Scheme. The RBI Retail Direct Scheme is aimed at enhancing access to government securities market for retail investors, while The Reserve Bank - Integrated Ombudsman Scheme aims to further improve the grievance redress mechanism for resolving customer complaints against entities regulated by RBI. Buying in software and technology stocks too aided sentiments. Positive cues from regional peers too supported the up move.

The BSE Sensex is currently trading at 60293.21, up by 373.52 points or 0.62% after trading in a range of 59997.96 and 60324.08. There were 23 stocks advancing against 7 stocks declining on the index.

The broader indices were trading in green; the BSE Mid cap index rose 0.30%, while Small cap index was up by 0.08%.

The top gaining sectoral indices on the BSE were Telecom up by 1.33%, TECK up by 1.25%, IT up by 1.20%, Energy up by 1.04%, Power up by 0.81%, while PSU down by 0.27%, Metal down by 0.26%, Basic Materials down by 0.21%, Auto down by 0.16%, Utilities down by 0.01% were the top losing indices on BSE.

The top gainers on the Sensex were Tech Mahindra up by 2.69%, Infosys up by 1.76%, Bharti Airtel up by 1.54%, Asian Paints up by 1.45% and HDFC up by 1.31%. On the flip side, Bajaj Auto down by 3.40%, Tata Steel down by 1.59%, NTPC down by 1.32%, Power Grid down by 1.04% and Axis Bank down by 0.52% were the top losers.

Meanwhile, rating agency ICRA in its latest report has said that the states will forego around Rs 44,000 crore of tax revenue after they reduced VAT on petrol and diesel in the remainder of the fiscal (FY22) but higher central tax devolution of Rs 60,000 crore will offset the losses. After months of calls for lowering the taxes on the fuels, the Centre on November 4, 2021 has reduced the excise duty levied on petrol and diesel. While the excise duty on per litre of petrol has been reduced by Rs 5, the same has been brought down on diesel by Rs 10. Following this, as many as 25 states and Union territories have lowered value-added tax (VAT) on these fuels.

According to the report, the FY22 revenue loss of the states from the tax cut is around Rs 44,000 crore, of which Rs 35,000 crore is by way of lower VAT and the rest indirectly. But, the states are not losing money as they are getting Rs 60,000 crore of additional revenue from the Centre as part of the higher-than-budgeted tax devolution. While the Central excise reduction leads to no direct revenue loss to the states, the reduction of VAT, which is levied on an ad valorem basis, the excise cut will lower their VAT inflows by Rs 9,000 crore.

Accordingly, rating agency said the direct revenue loss to the states and UTs from VAT cuts is around Rs 35,000 crore, taking the total revenue foregone to around Rs 44,000 crore for FY22, which is in line with the expected revenue loss of the Centre. Factoring in the impact of the excise duty cut and expectations for mobility and the economic recovery with the rising COVID-19 vaccine coverage, it forecasts the consumption of petrol and diesel to rise 14 percent and 8 percent, respectively, in FY22. However, the Central tax devolution is likely to exceed the FY22 budget estimates by a substantial Rs 60,000 crore, and the FY21 provisional actuals by a healthy Rs 1.3 lakh crore.

The CNX Nifty is currently trading at 17983.75, up by 110.15 points or 0.62% after trading in a range of 17905.90 and 18000.85. There were 36 stocks advancing against 13 stocks declining, while 1 stock remain unchanged on the index.

The top gainers on Nifty were Tech Mahindra up by 2.76%, HDFC Life Insurance up by 2.19%, Adani Ports & SEZ up by 2.03%, Hindalco up by 1.89% and Infosys up by 1.74%. On the flip side, Bajaj Auto down by 3.41%, Tata Steel down by 1.67%, NTPC down by 1.32%, Power Grid down by 1.02% and IOC down by 0.75% were the top losers.

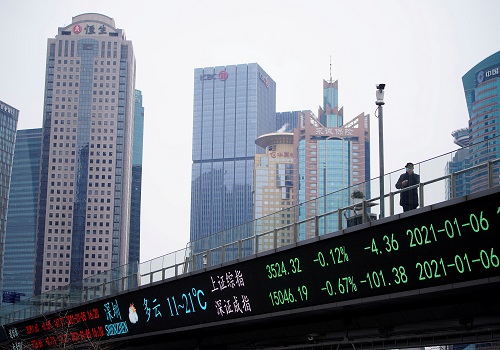

Asian markets are trading mostly in green; Nikkei 225 surged 332.11 points or 1.13% to 29,609.97, Hang Seng rose 48.04 points or 0.19% to 25,296.03, Taiwan Weighted advanced 65.61 points or 0.38% to 17,518.13, KOSPI jumped 43.88 points or 1.50% to 2,968.80 and Shanghai Composite added 6.00 points or 0.17% to 3,538.79. On the other hand, Straits Times fell 6.04 points or 0.19% to 3,232.03 and Jakarta Composite was down by 32.68 points or 0.49% to 6,658.66.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Markets started the week on a strong note and gained nearly a percent - Religare Broking