Japan`s lower house approves Kazuo Ueda as next BOJ chief

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

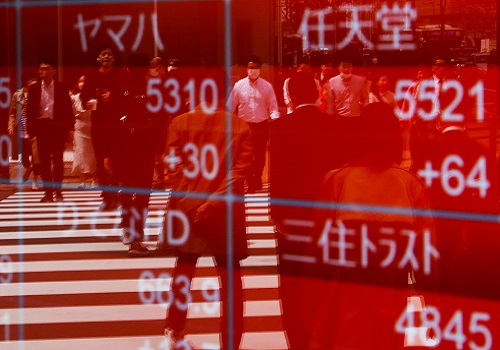

Japan's lower house of parliament on Thursday endorsed the appointment of economist and academic Kazuo Ueda as the new Bank of Japan (BOJ) governor.

Following his expected approval by the upper chamber on Friday, Ueda, 71, a former BOJ policy board member, will succeed Haruhiko Kuroda whose 10-year tenure will end on April 8, Xinhua news agency reported.

Ueda and the government's picks for two BOJ deputy governors were approved by a majority vote in the more powerful lower chamber, which is controlled by the ruling Liberal Democratic Party (LDP) and its junior Komeito coalition ally.

The vote was not unanimous, however, with the Japanese Communist Party voting against the appointments of Ueda and Ryozo Himino, a former Commissioner of the Financial Services Agency, and the government's nominee for one of the bank's deputy governor positions.

The main opposition Constitutional Democratic Party and the Japanese Communist Party both voted against Shinichi Uchida, an executive director at the central bank, as the other pick to be the bank's deputy governor, meanwhile.

Following Ueda's expected approval on Friday, he will be charged with heading Japan's central bank for five years and guiding its policy to achieve the bank's long-held target of achieving a two per cent inflation target in a stable manner.

Ueda, who was instrumental in introducing the BOJ's zero interest rate policy and quantitative easing measures, has indicated he plans to stick to the central bank's massive monetary easing programme to underpin the country's largely stagnant economy, despite the programme being heavily criticised for requiring massive purchases of government bonds.

On Japan's economic doldrums, the Cabinet Office here said on Thursday that the country's economic expansion was downwardly revised from 0.6 per cent to an annualized real 0.1 per cent in the October to December period.

This was owing to public consumption and capital expenditure remaining strained under inflationary pressure and a weak yen. The latter has been caused in part by a widening interest rate gap between the BOJ and its global peers, including the US Federal Reserve, which has been hiking its interest rate to tame decades-high inflation.

Ueda, a Shizuoka Prefecture-born academic, who earned his doctorate from the Massachusetts Institute of Technology in the US, has said he believes that current inflationary pressure is predominantly "cost-push" and is down to rising import prices.

He has said that the cost-push factors are temporary and would eventually give way, with inflation dropping below the 2 per cent-mark later this year.

The former Kyoritsu Women's University professor's remarks, however, run contrary to those of US Federal Reserve Chairman Jerome Powell, who told a hearing of a Senate committee recently that larger and faster interest rate hikes could be expected forthwith owing to high inflation.