It would be interesting to see whether we continue this profit booking mode to test these levels first - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

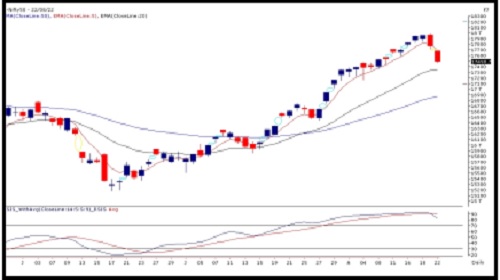

Sensex (58774) / Nifty (17491)

Friday’s sharp profit booking was a precursor of some sustainable decline after reaching the psychological mark of 18000. With US markets concluding the week on a weak note, we started the monthly expiry week on a sluggish note. The selling augmented right from the word go to break 17600 first and then eventually drifted below the key point of 17500 towards the end. The banking was the major culprit in this weakness followed by few capital goods as well as heavyweight IT counters. It also turned out to be a brutal session for broader market as NIFTY MIDCAP 50 index concluded with more than a couple of percent cut

After two months’ of relentless BULL run, all markets across the globe are undergoing some profit booking now. We are certainly not spared with it. With reference to previous commentary, Friday’s weak close was clearly an indication of further decline in our markets, which did happen on expected lines. However, we must accept the fact that it’s slightly extended our projected intraday levels. Now, the next cluster of support is visible in the vicinity of 17400 – 17350. It would be interesting to see whether we continue this profit booking mode to test these levels first or slightly oversold market opts for some relief in coming session. In our sense, the momentum traders should lighten up shorts if we reaches this support zone first or aggressive traders can even look to take a punt on the long side there.

Nifty Bank Outlook (38298)

Bank Nifty as well started with a gap-down opening and with no major bounce it remained under pressure throughout the session to end with a loss of 1.77% tad below 38300 levels.

The bank index was the charioteer of the recent up trend and now when we are correcting it has become the major dragger in the last two sessions. Now considering the peak and trough analysis or moving averages we are in an uptrend however in the current scenario we are in a correction mode of this uptrend. The correction or Secondary trend is the most difficult time to trade and hence one should ideally identify support levels from where the prices can resume the uptrend. However, one should not jump into trades when prices reach the levels and wait for some signs of positive momentum to enter the trade. The key levels to watch as a support would be at 38000 followed by 37700 levels. On the flip side, the bearish gap left yesterday around 38700 - 38850 can act as immediate resistance. We continue to see volatility on the higher side hence one should be very selective and avoid undue risk.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One