Ipca Laboratories gains on acquiring further 6.53% stake in Trophic Wellness

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

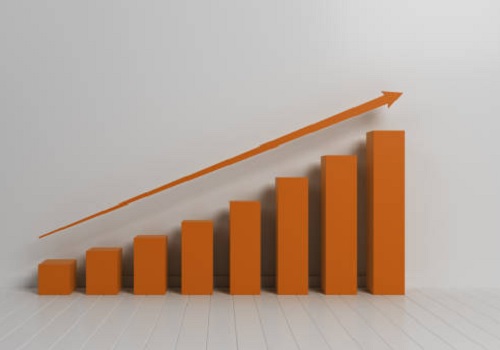

Ipca Laboratories is currently trading at Rs. 856.00, up by 1.60 points or 0.19% from its previous closing of Rs. 854.40 on the BSE.

The scrip opened at Rs. 866.70 and has touched a high and low of Rs. 866.70 and Rs. 848.40 respectively. So far 2726 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 1 has touched a 52 week high of Rs. 1124.40 on 10-Jan-2022 and a 52 week low of Rs. 831.40 on 13-Jun-2022.

Last one week high and low of the scrip stood at Rs. 873.85 and Rs. 840.05 respectively. The current market cap of the company is Rs. 21747.53 crore.

The promoters holding in the company stood at 46.29%, while Institutions and Non-Institutions held 44.35% and 9.35% respectively.

Ipca Laboratories has acquired further 6.53% of the paid-up equity share capital of Trophic Wellness (TWPL), a company incorporated under the Companies Act, 1956 and engaged in the business of manufacturing and marketing several SKUs of Neutraceuticals under the brand name ‘Nutricharge’. With the acquisition of these further 6.53% of the equity share capital of the said Trophic Wellness, the company now holds 58.88% of the paid-up equity share capital of said company.

Cash Consideration of Rs 10.58 crore was paid for the additional acquisition of 6.53% shareholding of TWPL. This further acquisition of shares will consolidate the Company's holding in this profitable subsidiary and will help the Company to grow its neutraceuticals portfolio and business.

Ipca Laboratories is engaged in manufacturing of active pharmaceutical ingredients and formulations.