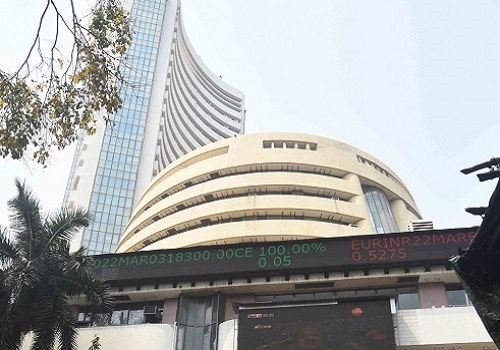

Indian shares rise on IT, metals boost; inflation data in focus

Indian shares were higher in early trade on Monday, as technology and metal stocks advanced, while investors awaited domestic inflation data for cues on the pace of the central bank's rate hike.

The NSE Nifty 50 index was up 0.38% at 17,901.70, as of 0352 GMT, and the S&P BSE Sensex rose 0.36% to 60,005.65, after hitting a three-week high in the previous session. Last week, both the indexes rose 1.68% to log their first weekly gain in three.

India's retail inflation, data due later in the day, likely snapped a three-month downward trend in August as food prices surged, a Reuters poll of economists showed, likely raising the specter of an aggressive rate hike by the Reserve Bank of India.

Domestic investor sentiment was also lifted by the sliding oil prices. Oil prices slipped on Monday on the prospect of further interest rate hikes in the United States and Europe, and over demand concerns following the imposition of COVID-19 restrictions in China. [O/R]

India, the world's third-largest importer of oil, benefits from a fall in prices as it brings down imported inflation.

In Mumbai trading, the Nifty IT index and the Nifty Metal index rose 1.26% and 1.04%, respectively.