Indian markets could open flat to mildly higher, following largely positive Asian markets today and flat US markets on Tuesday - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets could open flat to mildly higher, following largely positive Asian markets today and flat US markets on Tuesday - HDFC Securities

U.S. stocks ended flat on Tuesday, capping a turbulent session that saw markets swing between small gains and losses, as momentum for a record-setting market rally slowed.

The rally in equities lost some steam Tuesday, after surging to a series of new highs in recent days, helped by good earnings reports, progress in Congress on President Joe Biden’s fiscal relief plan and the accelerating rollout of coronavirus vaccines, along with declining new case numbers.

Equity mutual funds in India witnessed outflows for the seventh straight month in January as investors remained cautious ahead of the Union Budget presentation. Investors pulled out a net Rs 9,253.22 crore from equity and equity-linked mutual fund schemes in January compared with an outflow of Rs 10,147.12 crore in the preceding month. China’s factory gate prices rose in annual terms in January (up 0.3%) for the first time in 12 months and at the fastest rate since May 2019.

The consumer price index (CPI) unexpectedly fell 0.3% in January from a year earlier, compared with no change tipped by the Reuters poll and a 0.2% rise in December. South Korea’s unemployment rate soared to a 21-year high in January (5.4%), while the number of people employed fell at the sharpest pace in more than two decades, as curbs to contain the coronavirus continue to hurt the job market. Asian stocks inched higher on Wednesday, as upbeat Wall Street earnings and optimism about a global recovery supported sentiment, although concerns about the sustainability of a recent risk rally are likely to cap gains.

Lunar New Year public holidays begin across Asia. Chinese equities will be shut for a week. The Indian benchmark equity indices erased intraday gains post 1420 Hrs and ended with marginal losses on Feb 09, post a six day winning momentum. At close, the Nifty was down 6.50 points or 0.04% at 15,109.30.

Nifty 50 fell 150 points from the highest point of the day and ended marginally in the negative for the day accompanied by a negative advance decline ratio. 15257, the high of Nifty will now be a crucial level on the upside. The global markets have come under minor profit taking on the seventh day of the rally. If this continues, we could see the Nifty correcting more towards 14913 and later 14753.

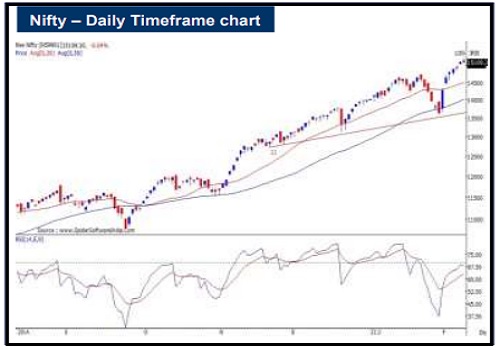

Daily Technical View on Nifty

Observation: Markets ended with marginal losses on Tuesday after a sell off from the highs brought the index into negative territory. Tuesday’s losses came after six consecutive sessions of gains for the Nifty. The Nifty finally lost 6.5 points or 0.04% to close at 15,109.3.

Broad market indices like the BSE Mid Cap and Small Cap indices lost more, thereby under performing the Sensex/Nifty. Market breadth was negative on the BSE/NSE. Sectorally, the top gainers were the BSE CD, Telecom and Capital Goods indices. The top losers were the BSE Auto, Realty, FMCG and Metal indices. Zooming into the Nifty 15 min charts, we observe that the Nifty opened with an upgap and then moved up gradually before witnessing selling pressure in the last one hour.

The selling led to the index closing below the 20 and 50 period moving average. This weakness could lead to more downsides in the very near term. On the daily chart, we can observe that the Nifty has convincingly reversed the recent downtrend by moving up from a trend line support and convincingly closing above the 50 day SMA last Monday.

With the uptrend intact, the Nifty now comfortably trades above the 20 day SMA. While there could be corrections in the very near term, we expect the index to make new life highs in the coming sessions. It is important that the Nifty does not move below the support of 14864 on any corrections for the short term uptrend to remain intact.

Conclusion: The 1-2 day trend of the Nifty is now down with the Nifty breaking its nearby intra day supports and closing below the 50 period moving average on the intra day chart. Nifty is likely to test the 15015 levels in the very near term. Our 7-day view on the market however remains bullish as the Nifty has convincingly reversed the recent downtrend by moving up from a trend line support and convincingly closing above the 20 day and 50 day SMA. Our bullish bets for the next 7 sessions would be off if the Nifty moves lower and closes below the 14864 levels.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions