India doubles healthcare spending, opens up insurance to more FDI to get growth back up

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NEW DELHI - India proposed doubling healthcare spending in an annual budget unveiled on Monday and lifted caps on foreigners investing in its vast insurance market to help revive an economy that suffered its deepest recorded slump as a result of the pandemic.

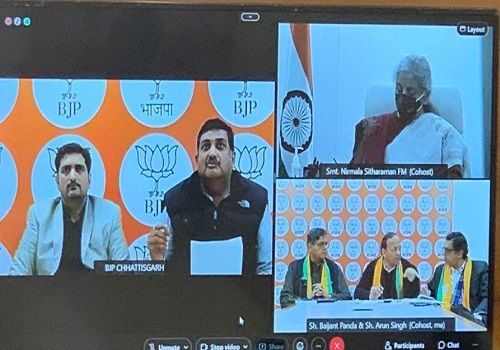

Delivering her budget statement to parliament, Finance Minister Nirmala Sitharam projected a fiscal deficit of 6.8% of gross domestic product for 2021/22, higher than the 5.5% forecast by a recent Reuters poll of economists. The current year was expected to end with a deficit of 9.5%, she said, well up from the 7% expected earlier.

India, which has the world's second highest coronavirus caseload after the United States, currently spends about 1% of GDP on health, among the lowest for any major economy.

Sitharaman proposed increasing healthcare spending to 2.2 trillion Indian rupees ($30.20 billion) to help improve public health systems as well as the huge vaccination drive to immunise 1.3 billion people.

"The investment on health infrastructure in this budget has increased substantially," she said as lawmakers thumped their desks in approval.

Millions of people lost their jobs when the government ordered a lockdown last year to combat the coronavirus. The government estimates the economy will contract 7.7% in the current fiscal year ending in March but then recover to show 11% growth in 2021/2022,

That would make it the world's fastest growing major economy ahead of China's projected 8.1% growth, but the government said it would take the economy two years to reach pre-pandemic levels.

"The indications are that the government is going to do more to promote growth rather than maintaining fiscal discipline," said Sujan Hajra, chief economist at Anand Rathi Securities in Mumbai.

"This is a welcome move as it will have a positive impact on growth. Also, we are seeing a lot of measures on conditions of doing business which was required. The intent for reforms is also strong."

Sitharaman said the foreign direct investment (FDI) cap for the insurance sector would be increased to 74% from the current 49%.

She also allocated 200 billion rupees ($2.74 billion) to recapitalise state-run banks that are saddled with bad loans and have been a drag on growth.

India's benchmark 10-year bond yield rose sharply to 6.03% from the day's low of 5.93% on the fiscal projections.

To bridge some of the deficit, the government plans to raise 1.75 trillion Indian rupees from selling its stake in the state run companies and banks including IDBI bank, an insurance company and oil companies.

The pandemic ruined the divestment plans for the current fiscal with only 180 billion rupees raised so far from the sales.

($1 = 72.8370 Indian rupees)

(Additional reporting by Delhi, Mumbai and Bengaluru bureaus; Writing by Sanjeev Miglani; Editing Simon Cameron-Moore)

.jpg)