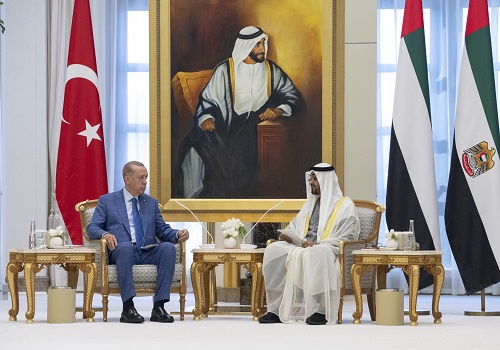

India, UAE ink MoUs to promote local currencies in cross-border trade

With an aim to increase circulation of the rupee in the Gulf region, the Reserve Bank of India (RBI) has inked two memoranda of understandings (MoUs) with the Central Bank of UAE (CBUAE) in Abu Dhabi for establishing a Framework to Promote the Use of Local Currencies viz. the Indian rupee (INR) and the UAE Dirham (AED) for cross-border transactions; and cooperation for interlinking their payment and messaging systems. The two MoUs are aimed at facilitating seamless cross border transactions and payments, and foster greater economic cooperation between the two countries.

The MoU on establishing a framework for the use of local currencies for transactions between India and UAE, aims to put in place a Local Currency Settlement System (LCSS) to promote the use of INR and AED bilaterally. The MoU covers all current account transactions and permitted capital account transactions. Creation of the LCSS would enable exporters and importers to invoice and pay in their respective domestic currencies, which in turn would enable the development of an INR-AED foreign exchange market. This arrangement would also promote investments and remittances between the two countries. Use of local currencies would optimise transaction costs and settlement time for transactions, including for remittances from Indians residing in UAE.

Under the MOU on ‘Payments and Messaging Systems’, the two central banks agreed to cooperate on linking their Fast Payment Systems (FPSs) - Unified Payments Interface (UPI) of India with Instant Payment Platform (IPP) of UAE; linking the respective Card Switches (RuPay switch and UAESWITCH); and exploring the linking of payments messaging systems i.e., Structured Financial Messaging System (SFMS) of India with the messaging system in the UAE. The UPI-IPP linkage will enable the users in either country to make fast, convenient, safe and cost-effective cross-border funds transfers. The linking of Card Switches will facilitate mutual acceptance of domestic cards and processing of card transactions. The linkage of messaging systems is aimed to facilitate bilateral financial messaging between the two countries.