Index to endure its winning streak and eventually challenge lifetime high of 15400 in coming sessions - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE (Nifty): 15198

Technical Outlook

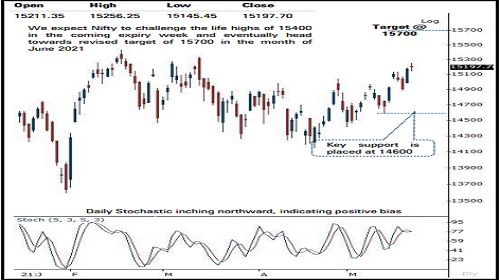

* The index oscillated within 100 points range after a firm opening on Monday. As a result, daily price action formed a high wave candle carrying higher high-low, indicating continuance of positive bias amid stock specific action as index witnessed follow through strength to Friday’s sharp up move

* We expect index to endure its winning streak and eventually challenge lifetime high of 15400 in coming sessions. The formation of higher peak and trough on the larger degree chart backed by improving market breadth highlights inherent strength that makes us confident to revise our target to 15700 for the month of June 2021, as it is 123.6% external retracement of FebApril Correction (15432-14151). Thereby, bouts of volatility owing to expiry week should be capitalised as incremental buying opportunity in quality large cap and midcaps

* The broader market indices sustained their relative outperformance as Nifty Midcap index maintained its record setting spree. Key point to highlight is that the outperformance in the broader market indices has been backed by improving market breadth as currently ~84% of index components are trading above their 50 days EMA compared to April reading of ~60%. We expect, broader market to accelerate their relative outperformance wherein catch up activity would be seen in small cap index, as Nifty Midcap index is placed at all time high whereas small cap index is still 5% away from lifetime highs

* Structurally, we believe any dip from hereon would get anchored around 14600 as index has formed a base formation at 14600 despite escalating concern over 2 nd wave of Covid-19. Thus strong support is placed at 14600 as it is confluence of:

* a) 80% retracement of current up move (14416-15256), at 14584

* b) past three week’s low at 14592

* In the coming session, index is likely to open with a positive gap tracking buoyant global cues. We expect Nifty futures to trade with a positive bias while maintaining higher high-low formation. Hence, use intraday dip towards 15230-15255 to create long for target of 15342.

NSE Nifty Daily Candlestick Chart

Nifty Bank: 34943

Technical Outlook

* The daily price action formed a high wave candle with a higher high -low signalling continuation of the positive bias as it sustains firmly above the April 2021 high (34287 )

* The index on Friday’s session rebounded after testing the recent falling supply line breakout area joining major highs of the last three months indicating strength and resumption of the up move

* We expect the index to maintain positive bias and head towards 36200 levels in the coming month as it is the confluence of the 80 % retracement of the entire last three months corrective decline (37708 -30405 ) and the price parity with previous up move (30405 -34287 ) as projected from the recent trough of 32115 signalling upside towards 36200 levels

* Index in the smaller time frame has witnessed a faster retracement of the last falling segment as 11 session’s decline (34287-32115) was completely retraced in just five sessions. A faster retracement in less than half the time interval signals a robust price structure

* The formation of higher high -low on the weekly chart signifies elevated buying demand that makes us assured to revise the support base higher towards 33000 levels as it is confluence of the 61 . 8 % retracement of the current up move (32115 -35216 ) and the rising 50 days EMA is also placed at 33130 levels

* Among the oscillators, the daily stochastic remain in uptrend and is currently placed at a reading of 80 thus supports the continuation of the positive bias in the index in the coming sessions

* In the coming session, the index is likely to open on a positive note amid firm global cues . We expect the index to trade with positive bias and maintain higher high -low . Hence after a positive opening use dips towards 35060 -35120 for creating long position for the target of 35370 , maintain a stoploss of 34940

Nifty Bank Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Index is likely to open on a flattish note today and is likely to remain range-bound during ...