In the coming session index is likely to open on a flat note - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

Technical Outlook

• The Nifty started the week on a buoyant note and surpassed psychological mark of 18000. However, profit booking in the second half of the week amid overbought conditions dragged index below 17600 mark. Consequently, weekly price action formed a bear candle with shadow on upper side, indicating profit booking at higher end

• Going ahead, we expect Nifty to consolidate ahead of FED event and gradually head towards January 2022 high of 18300 by October while strong support of 17300 is expected to be held. The index is undergoing healthy consolidation which will help to cool off the overbought conditions (daily and weekly stochastic oscillator cooled off to 36 and 56, respectively) ahead of U.S. Fed event in the upcoming week. Empirically, secondary correction in an integral part of the bull market that paves the way for next leg of up move. Thus, ongoing breather should not be construed as negative, instead dips should be capitalized to accumulate quality stocks. Our positive stance on index is based on following observation:

• a) Over past four weeks’ index has undergone slower pace of retracement by retracing merely 38.2% of mid July-August rally (15850-18000), thereby making market healthier

• b) Brent crude prices continue to trend downward after breaking their two-year support trend line. In coming weeks decisive break below 86 would lead further declines

• c) Indian equities continue to relatively outperform in the face of global volatility. Nifty500 ratio against S&P500 has given a breakout from decade long consolidation underscoring relative outperformance ahead

• Sectorally BFSI, Auto, PSU, Consumption, to relatively outperform

• In large cap space, we like, SBI, NTPC, Titan, Asian Paints, Maruti Suzuki, Bharti Airtel, United Spirits while our preferred midcaps are TCI, Cochin Shipyard, Kajaria Ceramics, Relaxo Footwear, SJVN, PCBL, Thermax, TCNS Clothing, VIP Industries, Oriental Hotel, Mazgoan dock

• Structurally, we expect extended breather from hereon would get anchored around 17300 mark as it is 80% retracement of recent 11 sessions rally (17166-18096) coincided with 50 days EMA placed at 17300

• In the coming session, index is likely to open on a flat note tracking muted global cues. We expect index to rebound post initial blip as strong intraday support placed at 17400. Hence, use intraday dip towards 17432-17464 for creating long position for the target of 17549

Nifty Bank

Technical Outlook

• The weekly price action formed a small bull candle with a long upper shadow signaling profit booking around the previous highs after the recent strong rally .

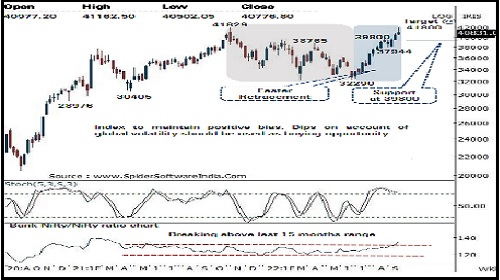

• Going ahead we expect the index to maintain positive bias and head towards 41800 levels . Dips on account of global volatility ahead of Fed event should not be construed as negative rather be used as buying opportunity . Index has strong support around 39800 levels .

• Structurally, the index has witnessed a faster retracement as eight month’s decline (41829 -32990 ) was completely retraced in just two and half months highlighting overall positive bias .

• In the weekly time frame after a strong rally of 29 % in just 13 weeks, index has approached overbought territory with a weekly stochastic reading of 83 . Hence, temporary breather cannot be ruled out after the recent strong outperformance which will make the overall trend healthier

• Bank Nifty continue to relatively outperformed the benchmark index in the last few quarters as can be seen in the Bank Nifty/Nifty ratio chart . It has recently generated a breakout above last 15 month’s range . Within the banking stocks PSU banking stocks has been resilient and showing relative strength . We expect the current outperformance to continue going forward

• The index has strong support around 39800 levels as it is the confluence of the 20 days EMA (currently placed at 39860 ) which has acted as strong support in the entire up move of the last two months and the 50 % retracement of the last three weeks up move (37944 -41840 ) In the coming session index is likely to open on a flat note amid mixed global cues . We expect the index to consolidate and trade in a range ahead of the FOMC outcome . The overall bias continues to remain positive . Hence use intraday dips towards 40510 -40590 for creating long position for the target of 40830 , maintain a stoploss at 40390

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct