IPO Note - Ethos Ltd By Jainam Share Consultant

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

About the company

• Ethos is the largest luxury and premium watch retailer in India and has watch portfolio of 50 premium brands in India such as Omega, IWC Schaffhausen, Jaeger LeCoultre, Panerai, Bvlgari, H. Moser & Cie, Rado, Longines, Baume & Mercier, Oris SA, Corum, Carl F. Bucherer, Tissot, Raymond Weil, Louis Moinet and Balmain.

• It has a chain of 50 physical stores in 17 cities of India in multi store format and operates on omnichannel model through its website and physical stores.

• It has a market share of ~13% in premium and retail luxury segment and ~20% in exclusive luxury segment.

• It has even undertaken retail of certified pre-owned luxury watched since 2019.

• Ethos revenue from operations stood at 41,859.3 lakh rupees as on Dec’21.

What is working for the company?

• Access to large luxury customer base to drive sales.

• Largest luxury and premium watch retailer in India.

• Founder led and professionally managed team.

• Early mover advantage in certified preowned business.

• Strategically located stores to cater to customers.

• Strong and long-standing relationships with watch brands.

What is not working for the company?

• The business is highly dependent on top 5 suppliers for procurement of products.

• Highly concentrated sales from certain stores.

• Part of a highly fragmented industry with intense competition.

• The business is man-power intensive and has high attrition rate.

• Volatile margins and inconsistent earnings.

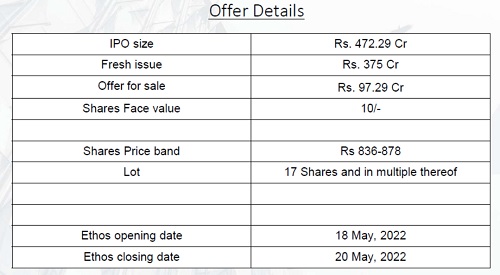

• Similar shares offered to promoters at ~Rs. 550 ( in Dec’21) and currently IPO is priced at ~Rs. 836-878.

Our Recommendation

We recommend you to AVOID to this IPO on the following parameters:

• The issue is very aggressively priced.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://jainam.in/

SEBI Registration No.: INZ000198735, Research Analyst: INH000006448, PMS: INP000006785

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer