Gold rises on dollar weakness, hopes of Fed easing rate hikes

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

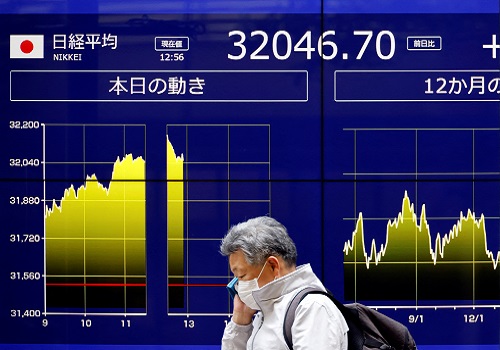

Gold prices rose on Thursday, hovering near a two-week peak hit a day earlier, as anticipation of the U.S. Federal Reserve easing the pace of its interest rate hikes weighed on dollar.

Spot gold rose 0.2% to $1,667.49 per ounce, as of 0537 GMT. Prices hit a two-week high at $1,674.76 on Wednesday.

U.S. gold futures were steady at $1,670.00.

The dollar index wallowed near its lowest level since Sept. 20 hit earlier, making greenback-priced gold cheaper for overseas buyers.

There have been some indications that other central banks and the Fed's rhetoric are softening, and that has given room for the dollar to correct lower and for gold to find a bit more footing, DailyFX currency strategist Ilya Spivak said.

Overnight, the Bank of Canada announced a smaller-than-expected rate hike, saying it was getting closer to the end of its historic monetary tightening campaign.

A Commerce Department report showed sales of new U.S. single-family homes dropped in September and data for the prior month was revised lower, supporting the view that Fed rate increases were already working.

While a fourth straight 75 basis-point rate hike at the Fed's November meeting is widely priced in, there are hopes that it may opt for a smaller increase in December.

Gold is highly sensitive to U.S. rate hikes, as these increase the opportunity cost of holding non-yielding bullion.

Investors are awaiting advance GDP estimates by the U.S. Commerce Department and the European Central Bank's policy decision due later in the day.

If Friday's personal consumption expenditures number is not wildly hotter than anticipated, gold could test $1,700 and then if the Fed stays "neutral", it could attempt to poke even above that, Spivak added.

Spot silver fell 0.3% to $19.56 per ounce, platinum was 0.3% lower at $948.48, while palladium rose 0.8% to $1,979.02.

.jpg)