Gold prices jumped as the Ukraine crisis and soaring inflation lifted demand for safe haven assets - ICICI Direct

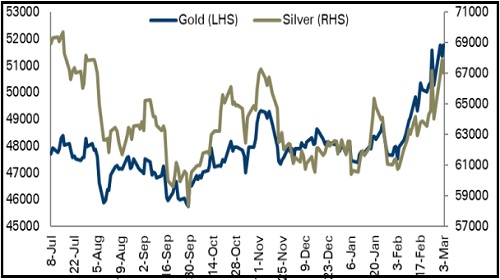

Bullion Outlook

Gold prices jumped as the Ukraine crisis and soaring inflation lifted demand for safe haven assets. Further, gold rallied on worries over stagflation. Investors are worried that prolonged elevation in oil prices could herald a combination of slowing growth and higher inflation. Additionally, gold held its solid gains on weaker than expected momentum in US service sector

However, further upside was capped on hawkish statements from Fed Chairman Jerome Powell and improved labour market. New applications for unemployment benefits declined and remained near historically low levels

Gold is likely to trade with a positive bias for the day as Russia’s invasion of Ukraine has led to uncertainty in the market. Investors fear a surge in commodity prices will feed into already elevated inflation. Market participants will assess how aggressively central banks globally will act to tame stubbornly high inflation without hampering economic growth. Meanwhile, markets will remain vigilant ahead of jobs data from the US

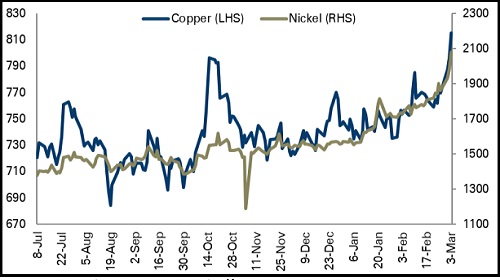

Base Metal Outlook

Base metal prices ended on a positive note on fears that widening sanctions on Russia for invading Ukraine threatened to further disrupt the flow of commodities

Additionally, a community in the Peruvian Andes has blocked a key transport road used by MMG’s Las Bambas copper mine disrupting supply

However, further upside was capped on risk aversion in the global markets, strong dollar and hawkish statement from the US Federal Reserve Chairman

Copper is expected to trade with a positive bias for the day amid worries over supply disruption and expectation of improved economic data from US. Further, continuously rising energy prices aggravated the concerns over production cuts. However, further upside may be capped as investors fear that demand for industrial metal may suffer as Russia’s invasion of Ukraine threatens to crimp world economic growth

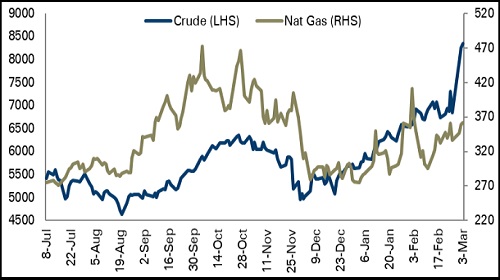

Energy Outlook

Crude oil prices continued to rally as the harsh sanctions against Russia for invading Ukraine disrupted Russian oil sales. Additionally, oil spiked on fresh round of US sanctions on Russian oil refining sector

Further, Opec+ stuck to an existing plan for gradual output rise of 400000 bpd a month ignoring consumer calls for more

However, further upside was capped on rising prospects for an Iran nuclear deal with world powers that could add supplies

Crude oil is expected to rally further for the day on worries that widening sanctions against Russia will disrupt oil sales. Additionally, oil prices may rally as inventories continued to fall. Ukraine crisis will provide further support to an oil market that has rallied on tight supplies and recovery in demand from pandemic. Meanwhile, markets will keep an eye on talks between Iran and world power over nuclear agreement. If the deal is restored then Iranian oil exports would help make up for the Russian barrels

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer