Going ahead we expect the index to trade with a positive bias and gradually head towards psychological mark of 18000 in coming weeks - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Nifty

Technical Outlook

• The Nifty recovered 150 points after initial gap down opening 17512-17423. The daily price action formed a bull candle that engulfed Wednesday’s real body, indicating buying demand at elevated support base

• Going ahead, we expect the index to trade with a positive bias and gradually head towards psychological mark of 18000 in coming weeks. However, bouts of volatility owing to overbought conditions on daily stochastic oscillator placed at 90 coupled with global uncertainty can not be ruled out. Hence, any breather from hereon should not be construed as negative. Instead, dips should be used as a buying opportunity amid progression of Q2FY23 earning season. Our positive view on the market is anchored by following observations:

• a) historically, over the past two decades, Q4 returns for Nifty has been positive (average 11% and minimum 5%) on 15 out of 21 occasions (70%). The history favours buying dips from here on • b) India Vix which gauge the market sentiment continued to drift downward over fourth consecutive week. The India VIX has inverse co-relation with the benchmark. Hence, falling VIX bodes well for boosting market sentiment

• c) US dollar/INR pair has approached key trend line resistance around 83.30 mark. Since 2015, on multiple occasions, the pair has reversed lower from this trend line amid extreme overbought readings on weekly timeframe. Stability in the rupee against the US dollar would support Indian equities in coming weeks

• Structurally, despite rise in volatility, the index managed to hold the psychological mark of 17000, indicating inherent strength amid elevated support base. Thereby, we revise our support to 17100- 17000 zone it is confluence of: a) 100 days EMA is placed at 17120 b) current week’s low is placed at 17098

• Broader market indices have bounced after forming a higher base above 100 days EMA. We expect the Nifty midcap and small cap indices to hold their September lows and stage a pullback in coming weeks amid commencement of earning season

• In the coming session, index is likely to open on a flat note tracking muted global cues. We expect index to trade with a positive bias amid elevated global volatility. Hence, use dips to create intraday long positions in the range 17468-17502 for target of 17587

Bank Nifty

Technical Outlook

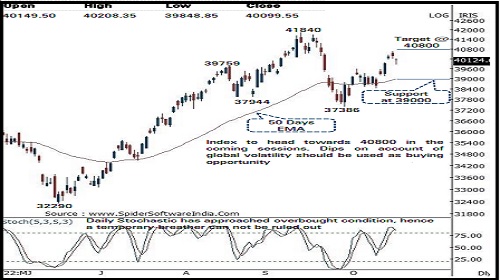

• The daily price action formed a Doji candle with a long lower shadow signaling support effort emerging around 39900 levels . The index opened on a soft note and formed an intraday low of 39848 in the midsession . However, buying demand in the second half in the PSU banking stocks saw the index recovering some of its intraday decline and closed the session around 40100 levels

• Going forward, we expect the index to maintain positive bias and head towards 40800 levels in coming sessions being the 80 % retracement of the recent breather (41840 -37386 ) . Dips on account of global volatility should be used as a buying opportunity

• Index after a sharp up move of more than 2000 points in just four sessions has approached overbought conditions in the daily stochastic with a reading of 85 , hence a couple of days of breather can not be ruled out which should not be constructed as negative instead should be used as a buying opportunity

• Structurally, on the longer time frame the index has already posted faster retracement on higher degree as eight month’s decline (41829 -32990 ) was completely retraced in just two and half months highlighting end of major corrective phase and structural improvement . Hence ongoing retracement of June - September rally should not be construed negative rather would make overall trend healthier

• The Bank Nifty has support at 39000 mark being the confluence of the current week low and the 50 % retracement of the current up move (37387 -40643 )

• In the coming session, index is likely to open on a flat note amid muted global cues . We expect the index to trade in a range while consolidating its recent gains amid stock specific activity . Hence use intraday dips towards 39970 -40050 for creating long position for the target of 40290 with a stoploss at 39860

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Top News

Astro Zindagi (Weekly Horoscope)

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct