Gladiator Stocks - Axis Bank and Bajaj Finance By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

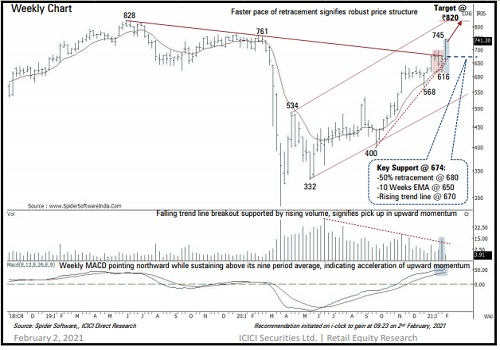

Axis Bank (AXIBAN): Falling trend line breakout augurs well for next leg of up move…

* The Bank Nifty clocked a fresh alltime high after witnessing faster pace of retracement, indicating acceleration of upward momentum in CY21. We expect catch up activity to be seen in Axis Bank, which has relatively underperformed the private banking space

* We expect the stock to resolve higher and gradually challenge lifetime highs around | 820 in coming months as it is upper band of past five months rising channel (as shown in chart), at | 830

* The share price has logged a resolute breakout from downward slating trend line backed by faster pace of retracement as it has retraced past nine session’s decline (| 691-616) in just three sessions, indicating structural turnaround. Hence, it offers a fresh entry opportunity to ride the next leg of up move over the medium term

* The stock has formed a higher base near key support threshold of | 674 as it is confluence of: o A) rising trend line placed at | 670

* B) 50% retracement of current up move (616-745), at | 680

* C) the stock recently bounced from 10 week’s EMA that has been held since September 2020, is at | 650

Buy Axis Bank Ltd @ 715.00-730.00 TGT 820.00 SL 674.00

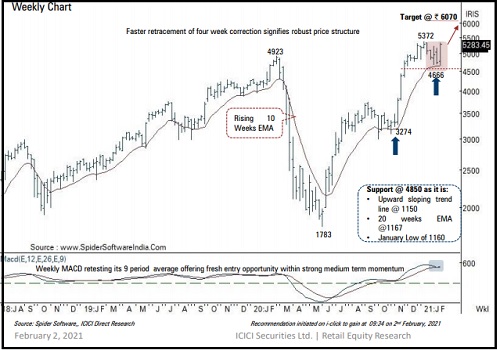

Bajaj Finance: Changing orbits after healthy consolidation

* The share price of Bajaj Finance has been key outperformer within NBFC space over the past few months and a healthy correction over four weeks ahead of Union Budget made the larger uptrend more robust

* We expect the stock to resolve higher from consolidation range (| 5372-4666=706 points) and head towards | 6070 as it is the breakout implication projected from (5372+706)

* The share price has undergone a healthy correction over five weeks by retracing less than 38% of preceding eight week’s rally (| 3274-5372). A shallow correction underlines strong buying demand at elevated levels

* The stock has formed a strong support base in the vicinity of | 4650 as it is confluence of upward sloping trend line (drawn adjoining May and October lows of | 1783-3274 and rising 10- week EMA which has been held since May 2020 lows

Buy Bajaj Finance Ltd @ 5150-5300 TGT 6070 SL 4830

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

Above views are of the author and not of the website kindly read disclaimer

.jpg)