Future Generali India Life Insurance`s new business premium grows 53% to 699 crores in FY23

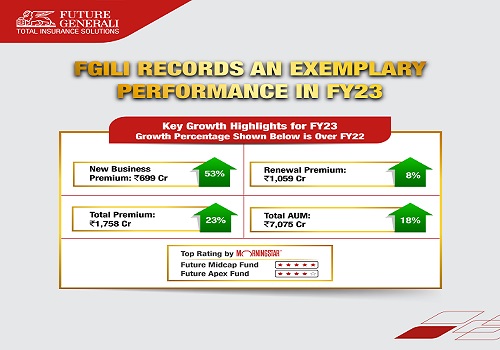

Mumbai: Future Generali India Life Insurance announced its business and financial accomplishments, for FY23. The New Business Premium for FY23 has touched 699 Crores against 457 Crores in FY22, growing by 53%.

The company has demonstrated remarkable progress across several key performance indicators. In contrast to the same period last year, the company has achieved a Total Premium of 1,758 Crores in FY23 with a noteworthy 23% rise as compared to FY22 at ?1,433 Crores. Furthermore, the Renewal Premium has witnessed an 8% growth touching ?1,059 Crores illustrating the company's effective retention of its existing policyholders as compared to FY22 at 977 Crores.

Further, the company witnessed a robust 18% growth at 7,075 Crores in Assets Under Management (AUM), reflecting a notable increase in the funds.

The flagship Equity ULIP Fund, Future Midcap Fund, has been rated 5 stars by Morningstar as of March 2023 and has also featured among the top-performing Midcap ULIP Funds for CY22 by Moneycontrol. Furthermore, the Future Apex Fund has also been rated 4 stars as per Morningstar.

The overall value of the policies in effect was highlighted by an impressive 13% growth to 1,36,806 Crores in the total sum assured in force (including riders), as compared to FY22 at ? 1,21,477 Crores.

Commenting on these achievements, Mr. Bruce de Broize, Managing Director & CEO of Future Generali India Life Insurance, said, "We are delighted by the resounding success of Future Generali India Life Insurance Co. Ltd. in FY23. Our dedicated workforce has played a pivotal role in acquiring new and retaining existing customers by providing customer centric solutions and delivering exceptional service. Customer-centricity is our priority, and our constant endeavour is to protect and prevent our customers from unforeseen events with judicious financial planning and providing them with an effortless and caring experience. Embracing technological advancements, we have developed user-focused online tools for seamless policy management. Committed to digital transformation, we aim to empower every customer we serve, making insurance a comfortable, positive and seamless experience.”

Future Generali India Life Insurance is backed by Generali Participations Netherlands N.V. (Generali) being a majority shareholder, increasing its direct share from 46.98% in FY22 to 73.99% as of May 2023. This showcases Generali’s commitment to the Indian sub-continent. Generali is poised to establish an even stronger presence in key Asian markets. It holds a strong capital position and an extensive customer base of 68 million spanning over 50 countries worldwide. With Generali’s contributions, the company is committed to driving success in the evolving insurance industry, providing personalized experiences, a compelling suite of products, and comprehensive support to its valued policyholders through digital solutions and unparalleled customer services.