Expiry Express - Bank Nifty opened positive and saw quite a volatile day moving in a range of 500 points By Motilal Oswal

BANKNIFTY : 35865

Bank Nifty opened positive and saw quite a volatile day moving in a range of 500 points. Banking stocks could see positive momentum and as a result the index was holding well above 35500 zones. It concluded the day with gains of around 590 points. It formed a Bullish candle on daily scale and is forming higher highs - higher lows from the last two sessions. Now it has to continue to hold above 35500 zones to witness an up move towards 36250 and 36500 zones while on the downside support exists at 35250 then 35000 levels.

Expiry day point of view:

Overall trend is buy on decline till it holds above 35500 zones Bank Nifty till it holds above 35500 zones it could see an up move towards 36250 then 36500 zones. Option traders are suggested to trade with nearby Call like 36000, 36100 strikes or Bull Call Ladder spread

Trading Range: Expected immediate trading range : 35250/35500 to 36250/36500 zones

Option Writing : Option writers are suggested to write OTM 36600/36700 Call and 35000/ 35100 Put with strict stop loss

Weekly Change : Bank Nifty is up by 1.81% at 35865 on a weekly basis. Bank Nifty VWAP of the week is near to 35700 levels and it is trading 180 points higher to the same indicates bullish bias.

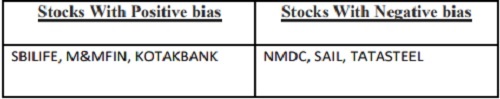

Key Data

Option Weekly Activity

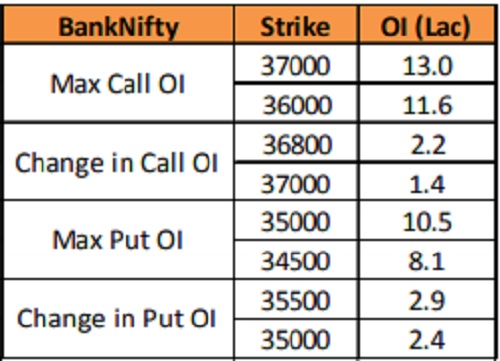

NIFTY : 15098

Nifty index opened positive and after a range bound start, it could not sustain at higher zones. However during the last hour, the index pulled back and closed near 15100 zones with gains of 143 points. It formed a Bullish Hammer like candle on daily scale with long lower shadow which indicates declines were being bought. Nifty has been moving in a consolidative manner from the last few sessions and not emerging in a clear direction. Now, it has to decisively cross and hold above 15100 zones to witness an up move towards 15200 and 15300 zones while on the downside immediate support exists at 15000 then 14900 levels.

Expiry day point of view:

Overall trend is bullish with buy on declines strategy but upside is also limited. Option traders are suggested to be with positive to range bound bias for an up move towards 15200/15250 zones. Buy nearby 15100 and 15150 Call or Bull Call Ladder Spread.

Trading Range : Expected wider trading range : 15000 to 15250 zones

Option Writing : Aggressive Option writers can sell 15300 Call and 14900 Put with strict double stop loss

Weekly Change : Nifty index is up by 1.07% at 15098 on a weekly basis. Nifty VWAP of the week is near to 15050 levels and it is trading 50 points higher to the same indicates overall positive to range bound bias.

Key Data

Option Weekly Activity

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Market Roundup: SBI Life, TechM, HUL, Hero Moto, Airtel, Prestige IPO & More - HDFC Securit...