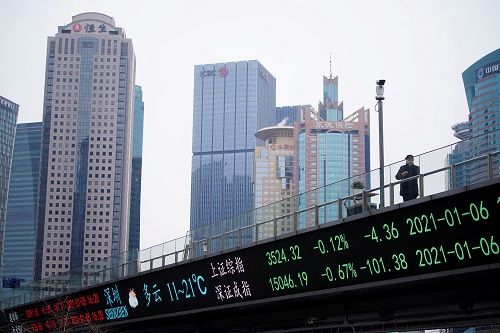

Error by Citigroup trader caused 'flash crash' in Europe markets

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

US banking giant Citigroup has said that one of its traders made an error in the so-called stock market "flash crash" in Europe, the media reported.

A flash crash is an extremely fast fall in the price of one or more assets, often caused by a trading mistake, the BBC said.

Trading was briefly halted in several markets after major share indexes plunged on Monday.

Nordic stocks were hit the hardest, while other European indexes also plummeted for a short time.

"This morning one of our traders made an error when inputting a transaction. Within minutes, we identified the error and corrected it," the New York-based bank said in a statement late on Monday.

The flash crash caused European shares to fall suddenly on a day when trading was particularly thin due to public holidays around the world, the BBC reported.

Sweden's benchmark Stockholm OMX 30 share index was one of the hardest hit, falling by 8 per cent at one point, before recovering most of those losses to end the day 1.87 per cent lower.

Flash crashes can be caused by human error, or so-called "fat finger" trades - a reference to someone incorrectly typing the details of a trade.

In August 2012, a computer-trading glitch at US financial services firm Knight Capital caused a major stock market disruption, costing the company around $440 million.

A flash crash on the Singapore Exchange in October 2013 saw some stocks lose up to 87 per cent of their value and resulted in new regulations being put in place to avoid a repeat of the incident.