Equity benchmarks extended gains over a second consecutive session - ICICI Direct

NSE (Nifty): 14648

Technical Outlook

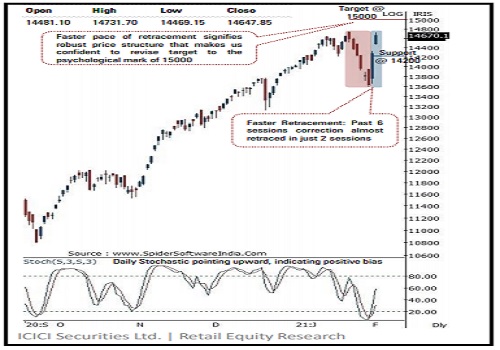

* Equity benchmarks extended gains over a second consecutive session amid buoyant global cues. The Nifty ended Tuesday’s session at 14648, up 367 points or 2.6%. The market breadth turned positive with A/D ratio of 1.8:1. All major indices ended in the green led by financials, auto.

* The Nifty witnessed follow through strength to Monday’s sharp up move as the index opened with a positive gap (14281-14469) and traded above the same throughout the session. As a result, daily price action formed a bull candle carrying higher high-low, indicating acceleration of upward momentum

* The index has almost retraced past six session’s decline (14753- 13597) in just two sessions. Faster pace of retracement helped the index to decisively close above 14500 mark, indicating robust price structure that makes us confident to believe that lifetime high will be challenged, going ahead, leading the Nifty to head towards our revised target of 15000 in coming weeks. We believe revived traction in cyclicals would drive Nifty towards 15000, as it is confluence of:

* a) 123.6% external retracement of last decline (14753-13597), at 15026

* b) Long term rising trend line drawn adjoining 2010-2015 highs of 6338 and 9119, placed around 15050

* Key point to highlight is that, after past two sessions swift up move of 1135 points, couple of days time consolidation cannot be ruled out. However, we believe any temporary breather from here on should not be construed as negative. Instead it should be capitalised on as incremental buying opportunity in quality large cap and midcaps to ride next leg of rally

* The broader market indices saw follow through strength by witnessing gap up opening, thereby confirming higher base in the vicinity of 50 days EMA, which has been held since June 2020 on multiple occasions, indicating elevated buying demand. The Nifty midcap index is hovering around life-time highs, whereas the small cap index is still ~25% away from all-time high. Thus, we expect small caps to witness catch up activity

* Structurally, the formation of higher peak and trough on the larger degree chart makes us confident to revise the support base for Nifty upward at 14200 as it is 50% retracement of current up move (13597- 14732) at 14164 coincided with the lower band of Tuesday’s gap (14469-14281) In coming session, we expect the Nifty to maintain its upward momentum by challenging lifetime highs of 14753. Hence, use intraday dip towards 14685-14705 to create long position for the target of 14793

NSE Nifty Daily Candlestick Chart

Bank Nifty: 34267

Technical Outlook

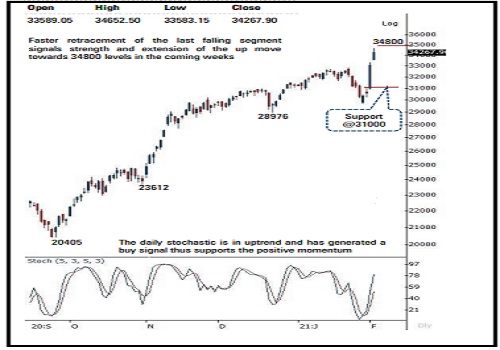

* The Bank Nifty extended Monday’s strong gains as buying demand continued at elevated level, lading index to fresh life highs on Tuesday . The index gained 3 .56 % to settle at 34267 . The private and PSU bank indices both gained 3 . 2 % each contributing to BankNifty gains alike .

* The daily price action formed a sizeable bull candle with an unfilled Bullish gap measuring 493 points below its low (33090-33583) signifying strong follow through momentum to Monday’s 8 % gains and extension of ongoing rally

* Going ahead, we expect the index to continue with its current positive momentum and head towards 34800 levels in coming weeks, as it is the 161 . 8 % external retracement of the recent corrective decline (32842 -29687 . The faster retracement witnessed of the last falling segment underscores structural improvement over medium term .

* The sharp up move of around 4900 points in past three sessions could result into a temporary breather of couple of sessions which should not be construed as a negative rather be utilised as fresh entry opportunity .

* We are confident in revising support upwards at 32000 mark which is : a) 50 % retracement of the current up move 29687 to 34652 placed at 32170 levels b) Value of a Trend line connecting past three session lows around 32000 levels

* In the coming session, we expect positive momentum to continue as Bank Nifty future is likely to open with a positive gap tracking firm global cues . Hence, we recommend utilizing intra day dips towards 34420 -34480 create fresh long positions in Bank Nifty February Futures to for target of 34610 meanwhile stop loss is placed at 34370

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Daily Technical Report 02nd January 2026 by Axis Securities Ltd