Equity benchmarks concluded volatile session on a positive note - ICICI Direct

Technical Outlook

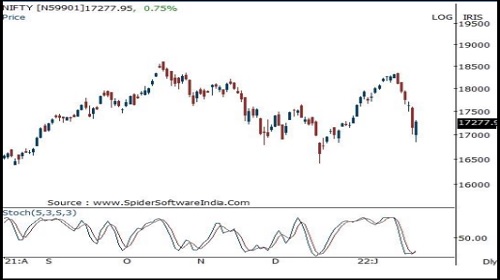

Equity benchmarks concluded volatile session on a positive note tracking bounce back in global peers. Nifty ended Tuesday’s session at 17278, up 129 points or 0.75%. Going ahead, holding above 16800 amid ongoing global volatility and follow through strength by forming higher high-low (on a closing basis) would indicate pause in downward momentum that would open the door for technical pullback in coming weeks. However, in case of breach of key support threshold of 16800, ongoing corrective phase would extend towards December 2021 low of 16400. Thus, key thing to watch amid ongoing global volatility would be sustenance above 16800 on a closing basis as it is confluence of:

a) 50% retracement of recent corrective phase (18350-16998)

b) current week’s high is placed at 17599

* Due to expected high volatility, in this report we are not recommending pre market index strategy. Subsequently, the strategy will be flashed in ICLICK-2-GAIN at the opportune time

Nifty Daily Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer