Equity benchmarks concluded the highly volatile week at 14372 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Technical Outlook

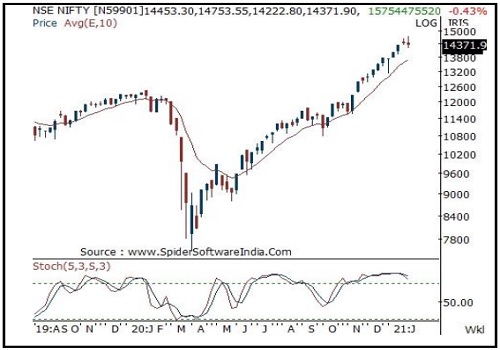

Equity benchmarks concluded the highly volatile week at 14372, down 0.4%. Since September low (10790) the Nifty has maintained the rhythm of not correcting for more than 2-3 consecutive sessions. In the coming session, as index has already corrected for past 2 sessions, we expect the index to maintain the same rhythm by holding Friday’s low (14358).

Hence, after a gap up opening use intraday dip towards 14400-14425 in Nifty January future for creating long position for target of 14514. Key point to highlight over past 11 sessions is that, the index has been oscillating in ~500 points range (14750-14220), indicating breather with positive bias which would make market healthy ahead of key major event of Union Budget.

Going ahead, we do not expect index to breach the strong support zone of 14000-13800. Hence, any dip from here on should be capitalized as incremental buying opportunity as we expect Nifty to head towards 14900 in coming month.

Nifty Weekly Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Morning Nifty, Derivative and Rupee Comments as of 26 December 2022 by Anand James, Geojit F...