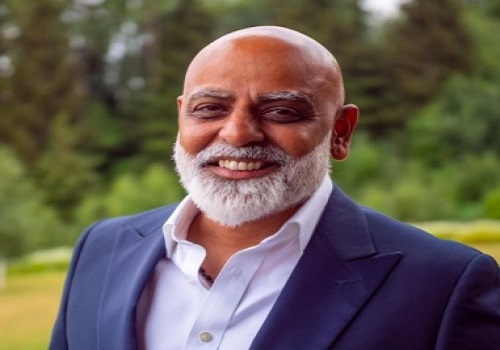

Digital Payment Index 2022 By Mr. Mandar Agashe , Sarvatra Technologies ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is quote on Digital Payment Index 2022 By Mr. Mandar Agashe, Founder & Vice-Chairman, Sarvatra Technologies ltd.

“Indian government created various platforms to help Indian citizens to transact digitally. As the payment methods were fast and convenient, Indian customers adopted them in a very big way which resulted in the acceleration of digital payments. The recent statistics from the RBI show that the Indian government's efforts to promote the adoption of digital payment methods across the country are paying off.

Large commercial banks, small finance banks, cooperative banks, and new-age fintech companies in semi-urban and rural areas have contributed significantly to expanding the reach of digital payments. With banks and several FinTech startups developing novel tech solutions to address citizens' financial problems, this growth has been relatively balanced.

Penetration of micro-ATMs, AePS, and PoS in rural India, constituting 65% of the country's population, has also played a crucial role in driving digital payments. We expect the government will continue to take positive measures to deepen the penetration of digital payment methods such as micro-ATM, UPI, AePS, and others, bringing the dream of a 'Digital India' closer. Additionally, innovative payment methods such as offline payment, tap, and pay, etc., are set for implementation is helping India outpace the global markets in digital transactions.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...