Derivatives Weekly View - Volatility to remain high in the settlement week ahead of Union budget By ICICI Direct

Volatility to remain high in the settlement week ahead of Union budget…

* The Nifty closed the week marginally negative amid extreme volatility and closed well below 14500 levels once again after making highs near 14750 levels during the week. Upcoming Union budget and result season has prompted sharp stock specific moves. However, globally equities have remained largely exhibited positive to range bound move last week. During the week, along with Nifty, midcap and small cap indices also witnessed some profit booking and closed the week negative.

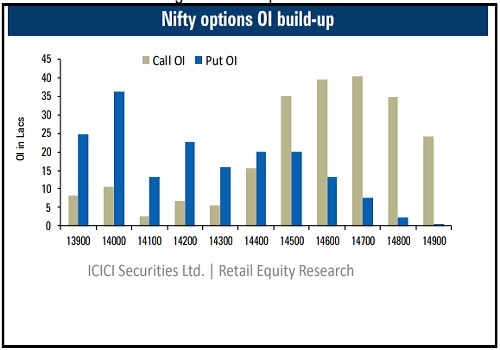

* From the options space, just like last week 14600 and 14700 Call strikes holds the highest Call base while the Put base is placed at 14000 strike. Immediate support for the index lies near its last week lows of 14200 and below which current declines might extend towards 14000 levels. On higher side, resumption of the trend can be expected only if Nifty moves above 14500 again.

* The volatility index has declined considerably from the highs of 25 and closed the week near 22 levels. Despite sharp decline seen in the last two sessions, volatility index has not seen sharp surge suggesting expectations of limited downs sides. Move towards 25 levels once again can be considered as a sign of caution.

* Sectorally, banking stocks were the major laggard of the week and they will remain in focus for any major recovery in the broader markets. Moreover, FII activity should also be kept under watch as their buying figure has declined gradually in the last couple of weeks. Hence a round of consolidation ahead of union budget can be expected in index.

Bank Nifty: More downside could be seen below 31000…

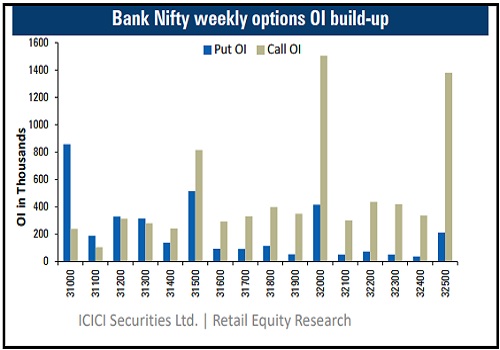

* Nifty as well as Bank Nifty futures managed to move towards its highest Call base of 14800 & 33000 respectively however, both failed to gauge follow up momentum. For the major part of the week Axis Bank along with HDFC Bank did well but selling on the last day of the week turned all the stocks negative except IDFC first bank.

* During the week fresh short OI blocks were seen in Bandhan bank followed by Kotak bank and Indusind bank whereas profit booking were seen in others which are likely to keep to keep the index move in check.

* Closure in Put OI positions and addition in OTM strike Calls like 32000, 32500 and 33000 are likely to keep index under pressure. Major Put OI concentration is placed in 31000 strike below which more downside could be seen. However, if Bank Nifty manages to hold 31000 in the expiry week bounce could only be seen till 32000 levels.

* Current price ratio of Bank Nifty/Nifty slipped further down as Nifty is still trading above its weekly low of 14250 whereas Bank Nifty is trading almost 700 points down from its previous weekly low. We feel due to such under-performance in banking stocks, upside may be restricted in Nifty

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Quote on?FPI Details by Shrikant Chouhan, Head Equity Research, Kotak Securities