Derivatives Strategy – Positional Option : Buy Indian Oil Corporation Ltd For Target Of Rs. 11 By ICICI Direct

Snapshot

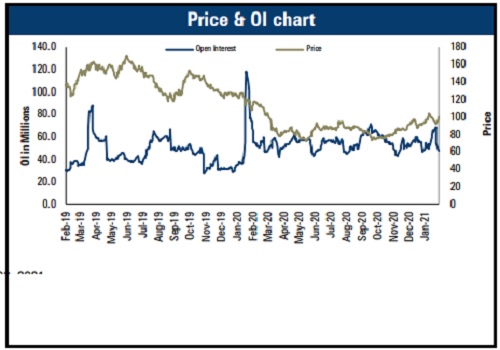

* OMCs remained in focus in recent days as price action was visible among all from recent low where IOC outperformed and moved above | 100 levels

* IOC had the highest Call base at 100 in which almost 12% OI was closed. The stock managed to close above 100 levels along with a pick-up in delivery volumes, which was observed around | 95 levels

* As the stock moved above | 100 levels, fresh long accumulation was observed, which is likely to continue in coming days

* On the back of closure in ATM Call strikes, the IV-spread is likely to move higher while activity is likely to pick up pace in far OTM strike. This would push the spread above its mean levels, which will be positive for the stock. We feel the stock is well placed to move above | 110 this expiry

Positional Option: Buy IOC February 100 Call at Rs. 4.4-5.0, Target: Rs. 11, Stop loss: Rs. 2.5, Time frame: Till October expiry

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer