Derivatives Strategy – Covered Call : Buy Canara Bank For Target Of Rs. 175 By ICICI Direct

Rationale

* For a couple of sessions, the Bank Nifty has been relatively outperforming the Nifty where buying is clearly visible in most private banks. However, after sell-off from recent high, fresh buying interest has emerged in most PSU banks

* Canara Bank, in particular, consolidated in the recent sell-off and largely found support near | 155 levels along with delivery based volumes

* Closure is visible in OTM Calls, which is the positive sign as we feel Call closure activity has started that will pull stock higher

* The IV-spread of Canara Bank-Nifty is hovering below its mean level. We feel that on the back of closure in Call writing positions, this spread would move higher towards its Mean + 2 Sigma levels

* As the Bank Nifty made a new life-time high we feel stocks from the PSU banking pack are likely to do well and Beta could be expected in Canara Bank

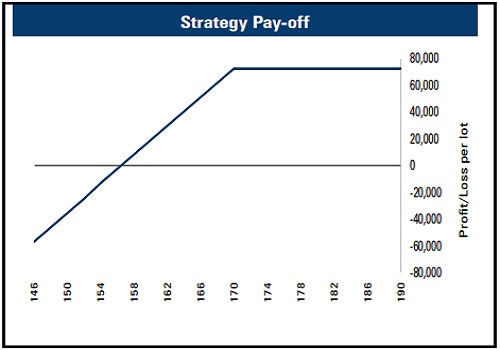

Buy Canara Bank Ltd @ 160.5-162.5 TGT 175 SL 149.5

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer