Data looks more supportiveforretaining long positions with an expectation of a move towards 17500 during the coming week - Tradebulls Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

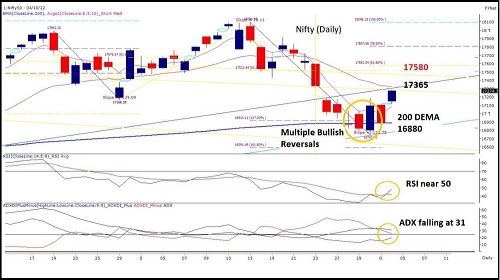

Nifty

On its daily scale; the effect of multiple reversal patterns viz. ‘Inverse Hammer’ followed by an ‘Engulfing Bullish’ candlestickformationnear its 200 DEMA support zone is evident now as the expected quick reversal occurred on time.Tuesdays price action toosawastrongprice up move sustained throughout the day. The immediate above its 20 DEMA zone of 17330 could push the index further towardsitskey resistance zone around 17580 (61.8% retracement zone of its prior decline). Its trend strength indicators have been divergingasitsdaily RSI saw a rebound from its oversold zone & now about to beak its 50 mark while ADX is still falling along with its declining-DI whichis a sign of lack of conviction. Derivative data for the day indicates strong support at 17100-17200 while sustenance above17300wouldbe critical to unlock an extended move towards 17400-17500 zone which looks unlikely or the day. Data looks more supportiveforretaining long positions with an expectation of a move towards 17500 during the coming week.Technically, since the index managedtohold itself above its 200 DEMA of 16880 as well as regaining strength to close the day above its 5 DEMA zone & nowapproachingits20DEMA support zone ahead of its earnings season could push the index eventually above 17365. Further longs could be consideredwithastop below 16780.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...