Crude oil prices traded higher with benchmark NYMEX WTI crude oil prices - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

GLOBAL MARKET ROUND UP

Commodity prices traded mixed with most of the commodities in non-agro segment traded higher while bullion prices witnessed some selling in closing session. Crude oil prices rallied on bullish weekly inventory data while base metals extended gains over higher demand prospectus on global economic recovery

U.S. Treasury Secretary Janet Yellen said Tuesday that interest rates may have to rise to keep a lid on the burgeoning growth of the U.S. economy brought on in part by trillions of dollars in government stimulus spending. Later she said that she sees no inflation problem brewing, downplaying earlier comme.

The U.S. trade deficit rose 5.6% in March to a record $74.4 billion. Data also showed U.S. factory orders rose 1.1% in March. Durable-goods orders rose a revised 0.8%. The trade imbalance with China increased more than 22% to $36.9 billion. The deficit with Mexico rose 23.5% to $8.4 billion.

BULLION

Bullion prices traded steady with spot gold prices at COMEX were trading near $1780 per ounce while spot silver prices at COMEX were trading flat near $26.50 per ounce in the morning trade. Bullion prices held steady range paring previous loses on mixed global cues. The gain in US treasury yields over the comments of rate hikes from Treasury secretary Jennet Yellen pressured precious metals. However, the FED’s stance is clear to keep ultra-low monetary policy.

We expect bullion prices to trade sideways to up for the day on mixed global cues. MCX Gold June resistance for the day lies at Rs. 47300 per 10 grams with support at Rs. 46700 per 10 grams. MCX Silver May support lies at Rs. 67500 per KG, resistance at Rs. 71500 per KG.

ENERGY

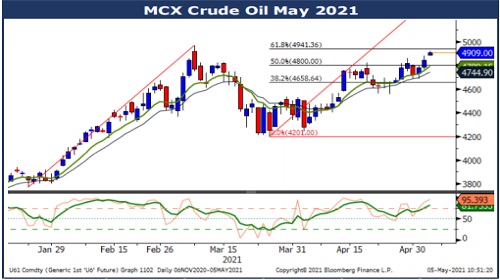

Crude oil prices traded higher with benchmark NYMEX WTI crude oil prices rallied by more than 2% to $66.24 per barrel in the morning trade. Crude oil prices traded higher on higher demand expectations with re-opening of US and European economies. Crude oil prices got boost from large weekly inventory draw as per API. The official weekly inventory data will be released tonight. The large scale vaccination drive in US and expectations of ease in lockdown in UK has improved demand outlook for oil.

We expect crude oil prices to trade up for the day. MCX Crude Oil May support lies at Rs. 4830 per barrel with resistance at Rs. 4980 per barrel.

BASE METALS

Base metals prices traded higher in the opening trade with most of the metals extended gains on Wednesday. Base metals traded higher on strong demand expectations on global economic recovery. The ease in lockdown measures in Europe and US infrastructure boost with stimulus package has boosted buying in industrial metals especially Copper. The improved manufacturing activities and push for green infrastructure has led LME Copper prices above $10000 per tonne.

Base metals are expected to trade higher for the day. MCX Copper May support lies at Rs. 763 and resistance at Rs. 772. MCX Zinc May support lies at Rs. 234, resistance at Rs. 240. MCX Nickel May support lies at Rs. 1310 with resistance at Rs. 1360.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer