Cocudakl trading range for the day is 2746-2894 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Cotton

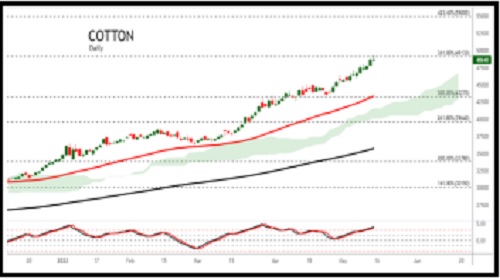

Cotton yesterday settled down by -0.57% at 49070 on profit booking after Union minister Piyush Goyal appealed to traders to divert only excess cotton and yarn for exports. Prices crossed 50000 mark on speculation that the scorching heat wave in North and central India may dent cotton production for the next marketing season beginning October 1. Lower production and global price rise pushed up domestic cotton prices above to ₹100,000 per candy of 356 kg last week. This is likely to attract farmers to grow cotton, which may lead to an increase of about 15-20 per cent in cotton acreage, according to preliminary estimates. Domestic textile industries are suffering because of unproportionate increase in domestic cotton prices as compared to the other markets because lower crop estimates. The Indian textile industry has lost its competitive advantage in global market as domestic cotton prices have registered highest increase in last one year, making Indian cotton more expensive. Global production is lowered by 1.8mln bales from last month, largely due to a drop of 1.0mln bales from India. Global use is down 1.1mln bales, and ending stocks are up 271,000 bales. Global trade is down slightly with a drop of 500,000 bales in India exports. Additionally, imports are lower for China, Pakistan, and Vietnam. U.S. production is slightly lowered to 17.5mln bales, exports are unchanged at 14.8mln, and ending stocks are lowered to 3.4mln bales. In spot market, Cotton gained by 80 Rupees to end at 50360 Rupees.Technically market is under long liquidation as market has witnessed drop in open interest by -4.84% to settled at 2161 while prices down -280 rupees, now Cotton is getting support at 48590 and below same could see a test of 48100 levels, and resistance is now likely to be seen at 49700, a move above could see prices testing 50320.

Trading Idea for the day

Cotton trading range for the day is 48100-50320

Cotton dropped on profit booking after Union minister Piyush Goyal appealed to traders to divert only excess cotton and yarn for exports.

Lower production and global price rise pushed up domestic cotton prices above to ₹100,000 per candy of 356 kg last week.

Global production is lowered by 1.8mln bales from last month, largely due to a drop of 1.0mln bales from India.

Cocudakl

Cocudakl yesterday settled down by -1.89% at 2801 after update that Global cottonseed production is projected at 44.1 million tons, up 3 percent, with gains in China, India, Turkey, and Uzbekistan. Cottonseed exports are forecast down nearly 2 percent, while crush is projected to grow 3 percent. Cottonseed oil trade is forecast to decline on lower export projections for the United States due to higher domestic demand. The new season for cotton is expected to be good. Retailer expects slight decline in dairy demand as supply uncertainties remain. Further pressure seen as Dairy farmers have demanded a hike in milk price in the midst of rising production cost, and the government has convened a meeting of farmers and farmers’ representatives in Thiruvananthapuram on May 10. Milk procurement prices have been rising, prompting higher revenues for dairy companies but also leading to pressure on margins in FY2023-24, according to a report. The new season for cotton is expected to be good for farmers as the market price of the fiber is currently more than MSP. Pressure seen in cotton also amid expectations of higher supply from the US and lower global demand. In its latest April report, the USDA increased the global cotton production forecast in 2021-22 to 120.2 million bales, compared to 119.9 million bales in Feb 2022. In Akola spot market, Cocudakl dropped by -12.6 Rupees to end at 3053.45 Rupees per 100 kgs.Technically market is under fresh selling as market has witnessed gain in open interest by 1.06% to settled at while prices down -54 rupees, now Cocudakl is getting support at 2774 and below same could see a test of 2746 levels, and resistance is now likely to be seen at 2848, a move above could see prices testing 2894.

Trading Idea for the day

Cocudakl trading range for the day is 2746-2894.

Cocudakl dropped after update that Global cottonseed production is projected at 44.1 million tons, up 3 percent, with gains in China, India, Turkey, and Uzbekistan.

Cottonseed exports are forecast down nearly 2 percent, while crush is projected to grow 3 percent.

Cottonseed oil trade is forecast to decline on lower export projections for the United States due to higher domestic demand.

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer