Buy Polycab India Ltd For Target Rs 3,455 Anand Rathi Share and Stock Brokers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Polycab, India

Seeding growth lever with changed FMEG revenue mix; retaining a Buy

Strong volume growth and the greater contribution from Wires, which

supported margin expansion, were Polycab, India’s key positives for

Q3FY23. Its foray into EHV cables could be a growth lever. Its targeted

change in its FMEG revenue mix could help expand margins.

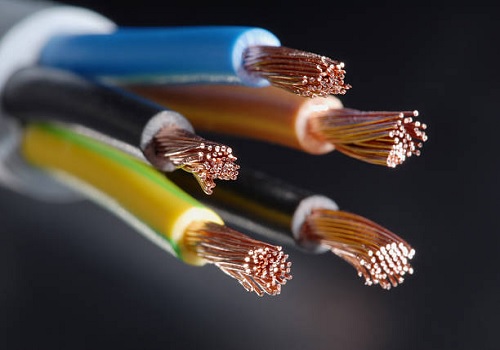

Strong volume growth, rising contribution from wires, key Q3 positives. Polycab’s Q3FY23 revenue increased 10% y/y as revenue from cables and wires increased 11% y/y (supported by 18-20%volume growth). FMEG revenue was flat y/y at Rs3.4bn, while revenue from “others”, which includes its EPC business, increased 27% y/y to Rs1.26 bn. Cable revenue of its peer Havells increased 17% y/y in Q3FY23, supported by strong demand from the industrial and infrastructural sectors. Its gross margin increased 310bps y/y, supporting a 284bp EBITDA-margin expansion. The improvement in the gross margin can be attributed to the change in the revenue mix as revenue from Wires increased to ~40% (vs a normal trend of 30%). Supported by an 83% y/y increase in other income, net income increased 45% y/y..

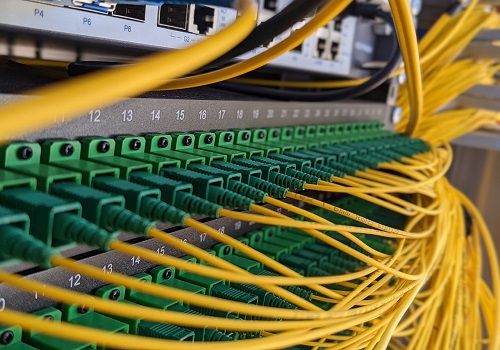

Foray into extra-high-voltage cables to broaden its cable range. Polycab intends to manufacture extra-high-voltage (EHV) cables upto 550kV, primarily used in power transmission. EHV cables are also used at air ports and in the railways. According to Polycab, the potential market for EHV cables in India is ~Rs40bn-50bn a year, besides export potential. The company has tied up with a 120-year-old Swiss company, Group Cables for technology. Polycab will be setting up a plant at Halol, Gujarat.

Rs4bn capex a year targeted for the next few years. As Polycab targets Rs200bn revenue by FY26 under its Project Leap, it would incur ~Rs4bn capex a year between FY23 and FY25.

Outlook &Valuations. At the CMP of Rs2,757, the stock trades at 30x/25x FY24e/FY25e EPS of Rs93/112. We maintain our Buy rating on it, with a higher TP of Rs3,455 (31x FY25e EPS of Rs112), earlier TP being Rs3,389 (31x FY25e EPS of Rs109.3).

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.rathi.com/LeadGenerate/Static/disclaimer.aspx

SEBI Registration No.: INZ000170832

Above views are of the author and not of the website kindly read disclaimer