Buy Jindal Stainless Ltd For Target Rs. 95 - Emkay Global

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Repayments accelerate; maintain Buy

* Consolidated EBITDA/PAT were 19%/68% higher than our estimates, driven by a 7% COGS beat. On a sequential basis, revenue/EBITDA/PAT rose 8%/37%/109%, aided by resurgence in demand and turnaround in subsidiary performance.

* The company repaid Rs5.8bn in Q3 amid strong operational performance. In 9MFY21, JSL repaid Rs9.8bn. Accordingly, the company only has Rs350mn in scheduled repayments in FY22, with enough headroom for new growth capex.

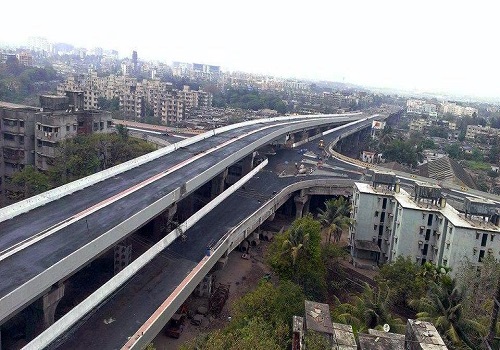

* JSL is set to embark on raising Jajpur plant capacity from 1.1mt to 1.9mt in 24months from the date of formal announcement at capex of Rs20-30bn. We believe that the expansion comes at the right time when demand for SS in India is poised to grow due to urbanization.

* We raise our FY21E EBITDA by 10% but keep FY22 estimates relatively unchanged despite a near-term uptick as the government revoked CVD on imports from Indonesia and China in the recent budget, capping potential ASP hikes. Retain Buy with an unchanged TP of Rs95. Dumping from Indonesia and china remains the key risk.

Next leg of growth at Jajpur: We believe that the company is poised to embark on the next leg of growth to take the capacity from 1.1mt to 1.9mt over the next 24 months and should be, in our view, planning for reaching the designed capacity of 3.2mt at Jajpur. The location was initially designed for 3.2mt integrated steel complex, which we believe can fructify over the next 6-7 years provided there is no dumping from China and Indonesia.

Merger with JSHL to drive the expansion: While we have built in capex of Rs15bn over the next 2 years from the internal cash flows of JSL, we note that the balance capex can be funded internally after the merger of JSL and JSHL, which the company has guide to be consummated in H2FY22. Hence, we do not build in additional debt/higher capex for JSL.

Outlook and valuation: We remain positive on the demand outlook for India as we believe that urbanization will boost demand for stainless steel and that there are limited domestic suppliers for high-end, value-added products in SS applications like auto, white goods, railways, etc., which are driven on contractual basis and not entirely dependent on spot markets. However, we are cognizant of the fact that the revocation of the CVD on imports from Indonesia and China will result in dumping of SS, especially in the lower spectrum of quality/price which can impact the overall profitability of JSL. Our assumptions already factor in a lower EBITDA/t and valuation multiple consequently. We value JSL at 5.5x compared to >7x at which global SS companies are currently trading. We still find the stock attractive due to its 1) deleveraged balance sheet, 2) improvement in overall metrics post-merger with JSHL, 3) increase in share of value-added products like automotive, medical and white goods, and away from lower end of the market. The stock currently trades at 4.6x our FY22E EV/EBITDA. Maintain Buy

To Read Complete Report & Disclaimer Click Here

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

Above views are of the author and not of the website kindly read disclaimer

.jpg)