Benchmarks end December series on flat note

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian equity benchmarks witnessed yet another range bound trading session and ended the December series on a flat note on Thursday, as investors remained cautious amid surging Omicron cases. The headline indices opened on a quite note but soon slightly inched up in early morning trade. Traders took some support with private report stated that employment opportunities in the e-commerce and allied industries witnessed a 28 per cent surge in 2021, and recruitment activities in this segment will gain further momentum driven by economic recovery and aggressive vaccination drive. Some solace also came with the Federation of Indian Export Organisations (FIEO) stating that the country’s exports are expected to register healthy growth rate in the next financial year (FY23) might touch $530 billion as exporters are flushed with orders. FIEO further stated that additional exports will come from some of the PLI (production-linked incentive) sectors in the next fiscal. Traders also took a note of the Reserve Bank of India’s (RBI) second Financial Stability Report (FSR) stated that the Omicron variant of coronavirus remains the major challenge along with rising inflation pressures, though the economy has steadily gained momentum and remained resilient since the second quarter of the current fiscal.

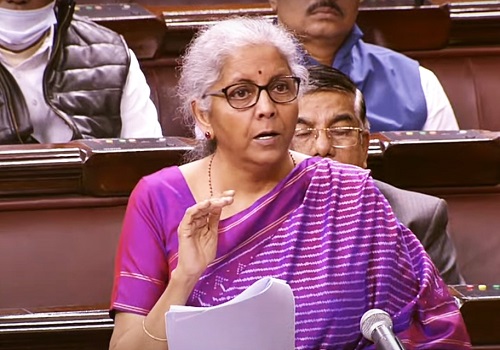

However, key gauges failed to hold positive momentum and ended flat, as investors remained anxious as authorities in various parts of India said the third wave of infections has begun. Virus cases more than doubled in Delhi and Mumbai in a single day, forcing the governments to enforce more restrictions. Some concern also came as the Reserve Bank of India (RBI) has flagged concerns on the deteriorating credit quality in the retail books of lenders and warned that the retail-led model of selling credit, led by housing loans, is confronting headwinds now. According to the financial stability report, between April and the first week of December, credit disbursal grew to 7.1 per cent as against 5.4 per cent growth a year ago and 5.2 per cent in March 2021. Meanwhile, the GST Council, chaired by Finance Minister Nirmala Sitharaman, will meet on December 31 and discuss, among other things, report of the panel of state ministers on rate rationalisation.

On the global front, Asian markets ended mostly lower on Thursday, while European markets were trading mostly in red as investors delve over the potential impact of the fast spreading Omicron Coronavirus variant. They also seem reluctant to continue making significant moves as the virus spreads rapidly across more countries, with some implementing lockdowns and strict restrictions. Back home, on the sectoral front, the telecom services sector stocks were in focus as ICRA revised outlook on telecom services sector to stable from negative and said the telecom tariff hike along with the recent relief package offers sufficient headroom for the industry to undertake deleveraging as well as fund capex for 5G tech upgrade. Stocks related to defence industry too were in focus as the defence ministry announced a fresh list of 351 sub-systems and components that will not be allowed to be imported under a staggered timeline beginning December next year.

Finally, the BSE Sensex fell 12.17 points or 0.02% to 57,794.32 and the CNX Nifty was down by 9.65 points or 0.06% to 17,203.95.

The BSE Sensex touched high and low of 58,010.03 and 57,578.99, respectively and there were 16 stocks advancing against 14 stocks declining on the index.

The broader indices were trading mixed; the BSE Mid cap index fell 0.22%, while Small cap index was up by 0.19%.

The top gaining sectoral indices on the BSE were IT up by 0.96%, TECK up by 0.82%, Healthcare up by 0.51%, Consumer Durables up by 0.43% and Telecom up by 0.10%, while Energy down by 1.62%, Oil & Gas down by 1.43%, Metal down by 1.15%, Realty down by 0.99% and Utilities down by 0.94% were the top losing indices on BSE.

The top gainers on the Sensex were NTPC up by 3.13%, HCL Technologies up by 1.94%, Titan Company up by 1.85%, Indusind Bank up by 1.74% and Wipro up by 1.52%. On the flip side, Reliance Industries down by 1.94%, Tata Steel down by 1.34%, Maruti Suzuki down by 0.82%, Bajaj Finance down by 0.63% and SBI down by 0.54% were the top losers.

Meanwhile, the Reserve Bank of India (RBI) in its second Financial Stability Report (FSR) has stated that the Omicron variant of coronavirus remains the major challenge along with rising inflation pressures, though the economy has steadily gained momentum and remained resilient since the second quarter of the current fiscal. RBI Governor Shaktikanta Das noted that after the destructive second wave in April-May 2021, the growth outlook has progressively improved, though there are headwinds from global developments and more recently from the Omicron virus.

He added that a stronger and sustainable recovery hinges on the revival of private investment and shoring up private consumption, which unfortunately still remain below their pre-pandemic levels. Admitting that inflation remains a concern as it is by the build-up of cost-push pressures, Das has called for stronger supply-side measures to contain food and energy prices. Noting that the financial institutions have remained resilient amidst the pandemic and stability prevails in the financial markets cushioned by policy and regulatory support, the governor is confident that the strong balance sheets of banks with higher capital and liquidity buffers will help mitigate future shocks.

Citing the stress tests on banks, the governor has also warned that gross NPAs may jump to 8.1-9.5 per cent by September 2022 from 6.9 per cent in September 2021. The bank noted that the scheduled commercial banks would, however, have sufficient capital, both at the aggregate and individual levels, even under stress conditions. The governor concluded by reiterating the Reserve Bank's resolute commitment to ensure a robust and efficient financial system that supports strong, sustainable and inclusive growth with macroeconomic and financial stability.

The CNX Nifty traded in a range of 17,264.05 and 17,146.35 and there was 23 stocks advancing against 27 stocks declining on the index.

The top gainers on Nifty were NTPC up by 2.68%, Indusind Bank up by 2.07%, HCL Technologies up by 1.94%, Titan Company up by 1.91% and Cipla up by 1.84%. On the flip side, Bajaj Auto down by 1.89%, Reliance Industries down by 1.60%, JSW Steel down by 1.58%, Tata Steel down by 1.35% and Maruti Suzuki down by 1.05% were the top losers.

European markets were trading mostly in red; UK’s FTSE 100 decreased 4.89 points or 0.07% to 7,415.80 and Germany’s DAX decreased 14.77 points or 0.09% to 15,837.48, while France’s CAC increased 9.66 points or 0.13% to 7,171.18.

Asian markets ended mostly lower on Thursday amid light volumes with year-end fast approaching, despite another record high closing of US shares overnight. Seoul shares ended lower despite positive industrial output data signalling an easing in global supply bottlenecks. Japanese shares declined as traders feared after the country confirmed a total of 502 new coronavirus cases on Wednesday, exceeding the 500-mark for the first time in over two months. However, Chinese shares advanced as Chinese authorities continued efforts to curb the Covid-19 outbreak in the western city of Xi'an. The Chinese investor sentiments cheered further as its government guaranteed to focus on a consumption recovery and reduce certain income tax rates. Hong Kong shares ended marginally higher even as China Evergrande Group shares falling more than 9 percent in Hong Kong after some holders of two China Evergrande Group dollar bonds with coupons due on Tuesday saying they had yet to receive payment.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...