Banking Sector Update : Superlative performance endures` recent stockcorrection offers re-entry opportunity By Emkay Global Financial Services

* Superior growth, margins, lower LLP boost profitability in 3Q: System credit growth remains strong at 16% YoY, as it did for most banks under our coverage, led by healthy traction in both, Retail as well as the corporate book. Margin performance was healthy, wherein most of the banks under our coverage largely reported an uptick (10-30bps QoQ) on better growth, LDR and continued asset-repricing benefit. This, along with healthy fee and MTM reversal adjusted for elevated cost, led to robust PPoP growth for banks. Asset quality continued to improve which, coupled with higher PCR, ensured that LLP continued sliding and, hence, boosting profitability (44% YoY). Despite making additional contingent buffer of Rs15bn in 1Q taking it to 1.1% of loans, ICICIB posted a beat on earnings on strong margin uptick. Axis Bank/Kotak Mahindra Bank, too, surprised positively on margins and, thus, on earnings. But HDFCB marginally disappointed on the growth/margin fronts. Among small-/mid-size PVBs, IIB, KVB and Federal Bank logged healthy performance, while City Union Bank, Yes Bank and Bandhan Bank disappointed. Among PSBs, BOB, SBI, Union Bank and Canara Bank surprised positively on growth/earnings, while PNB continued to disappoint.

* Rising interest rates to have tempering effect on growth/margins: The RBI recently raised repo rate by 25bps, while there is still risk of a further rate hike, albeit feeble, amid elevated inflationary readings. We believe the rising rates will have some tempering effect on credit growth, particularly in retail segment including mortgages and vehicles. That said, 4Q being seasonally-strong for corporate growth should provide some support. For FY23, we build-in overall credit growth of 16%, while growth could be slightly lower for FY24 (down 100-200bps), factoring-in the rate effect and macro moderation. Banks have largely consumed internal liquidity and may have to now push for deposit growth, mainly in view of the advance-tax outflows & credit growth. Banks have raised TD rates across tenures, but more so on in the 1-3 year bucket, so as to minimize impact caused by any turning of the rate cycle next year. We believe PVBs’ margins have largely peaked, while delayed repricing of MCLR-heavy PSBs could lead to continued margin uptick. On the other hand, opex is expected to remain elevated due to branch expansion, tech spends & DSA/DMA payouts, while for PSBs – adhoc provision for the new bipartite agreement and PLI-related provisions could keep cost elevated. Nevertheless, moderating LLP for most banks should support profitability. We expect RBL, Bandhan and PNB to report better earnings in 4Q vs 3Q.

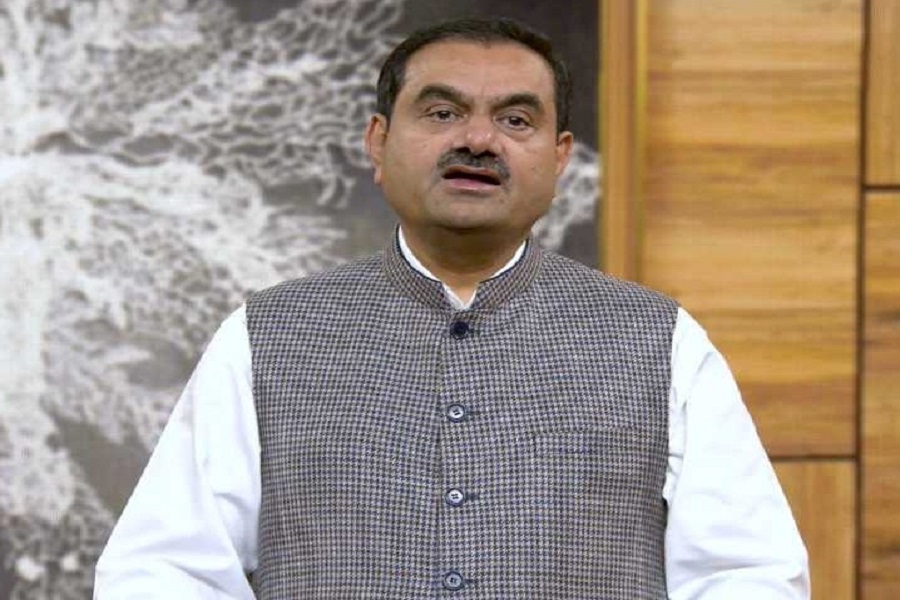

* Asset quality on the mend; Adani exposure remains high, but does not pose any default risk: Despite stress-flow from the restructured pool, banks continued to report net negative-slippages due to better recovery/upgrades. This, along with accelerated write-offs given the higher PCR and healthy credit growth, led to sharp drop in GNPA ratio, of 59bps to 2.3% for PVBs and of 53bps to 5.2% for PSBs. The latest bounce-rate trends do not show any visible build-up of stress, though banks need to be vigilant in the unsecured and BB/SBL segments, given rising interest rates. Corporate asset quality too remains under control, with increasing news-flow around a resolution. A few banks have declared their exposure to Adani – SBI’s being the highest at 0.9% of loans/8.4% of NW; Axis’s too turned out to be higher than expected, at 1.2% of loans/7% of NW. MFI players too are witnessing better collection trends, but for Bandhan which expect NPAs to moderate from 4Q onwards

* The recent correction offers a good re-entry point in select banks: Most banks (specifically PSBs) have seen a decent correction as a result of the exposure-concerns around the Adani Group; we expect the probability of default to remain considerably low, for now. Add to that banks are witnessing strong earnings momentum on the back of better growth/margins and receding LLP which, coupled with the strong provisions/capital buffer, provide additional comfort. Thus, we believe that the recent correction in some fundamentally-strong bank-stocks provides a good re-entry point. Among private banks, ICICIB remains our top pick, given its continued outperformance on growth/profitability and strong provision/capital buffers. Axis Bank, too, offers an attractive long-term Buy, given improving return ratios and lower valuations; also, HDFCB at current valuations offers a good defensive bet. We have, however, downgraded Kotak Mahindra Bank to Hold from Buy, as we get closer to the RBI-mandated event of top-management change (Jan-24). We have also upgraded PNB to Hold from Sell factoring expected improving in earnings trajectory and attractive valuations. Among mid-/small-cap PVBs, Federal Bank, KVB and RBL remain our preferred picks. Within PSBs, we prefer BOB, SBI, and Indian Bank, given their ability to deliver healthy return ratios, capital buffer and reasonable valuations. This report is intended for team.emkay@whitemarquesolutions.com use and downloaded at 02/16/2023 02:51 PM This report is intended for team.emkay@whitemarquesolutions.com use and downloaded

To Read Complete Report & Disclaimer Click Here

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

Above views are of the author and not of the website kindly read disclaimer